Navigating the 2025 Rental Landscape: April Update

As property operators gear up for peak leasing season, one question dominates the conversation: Is the long-awaited market turnaround finally happening? In our latest Rental Insights webinar on April 15th, Apartment List Sr. Economist Chris Salviati unveiled fresh data that suggests we may be at an inflection point, but with important nuances every multifamily professional needs to understand.

Here's what the latest numbers mean for your leasing strategy this summer, and how to position your properties for success in a market that's showing early signs of recovery.

Market Momentum: Turning the Rental Tide

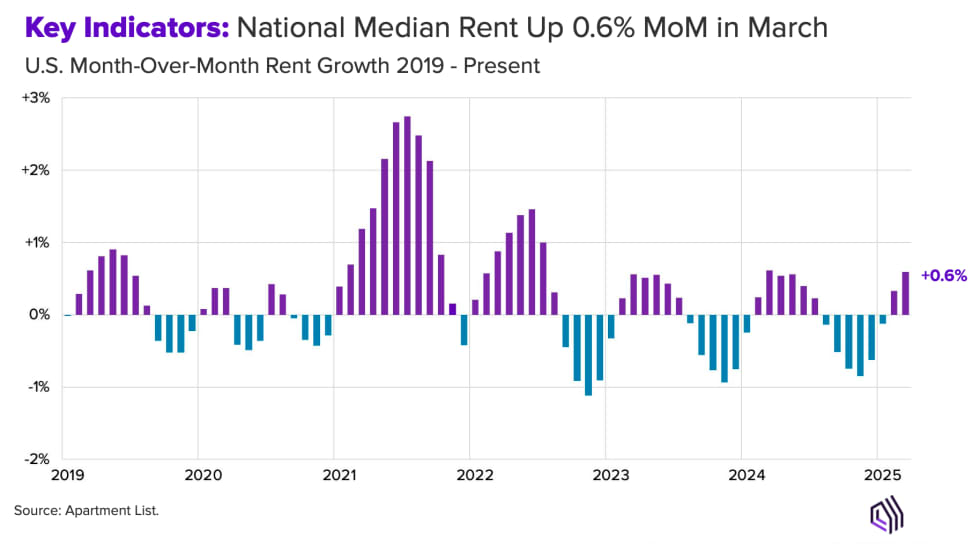

After a prolonged period of downward pressure, rent trends are showing the first meaningful signs of improvement. March delivered a 0.6% increase in the national median rent, the strongest monthly gain since last summer and an encouraging signal as we enter the crucial leasing season.

However, this uptick exists within a broader context that requires careful navigation: - Year-over-year metrics remain challenging: National rents still show a -0.4% decline compared to March 2024, though this represents an improvement from deeper negative territory earlier this year.

- Post-pandemic correction continues: Current rent levels sit 4% below their August 2022 peak, reflecting the ongoing market normalization after pandemic-era spikes.

- Supply pressure persists: The national vacancy index reached a new high of 6.9%, signaling that oversupply remains a significant headwind in many markets.

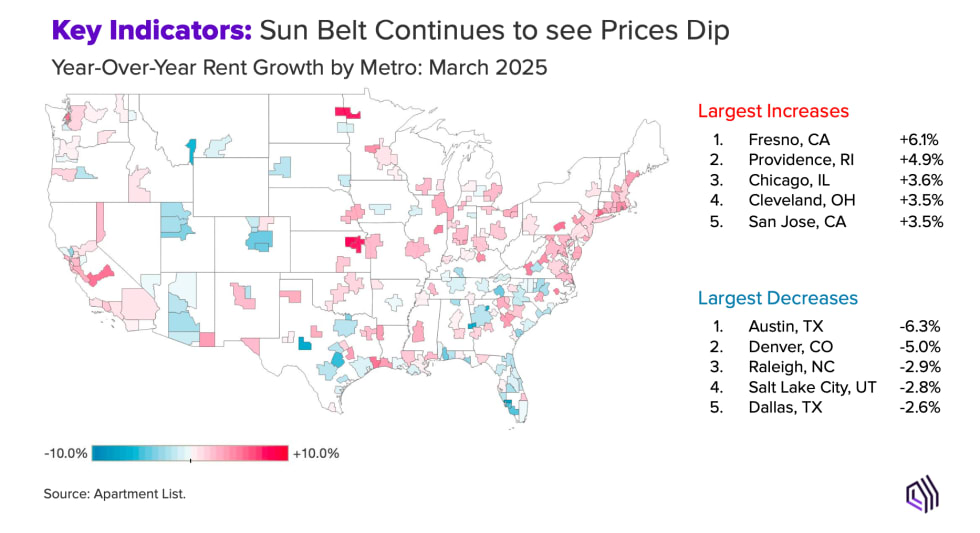

The geographic patterns reveal important distinctions for operators. While Sun Belt markets like Austin (-6.3%), Denver (-5.0%), and Dallas (-2.6%) continue to experience year-over-year declines, other markets are showing remarkable strength. Fresno (+6.1%), Providence (+4.9%), and Chicago (+3.6%) posted substantial gains, highlighting the increasingly localized nature of rental performance.

What This Means For You: This quarter represents a critical juncture where market fundamentals are beginning to shift. Property operators should calibrate expectations based on their specific metro dynamics rather than national headlines, with a focus on maintaining occupancy in markets still facing supply headwinds.

Renter Psychology: Selective, Deliberate, But Re-engaging

Understanding today's renter mindset is crucial for converting prospects. Our data reveals a market where renters are active but discerning, with several key behavioral shifts:

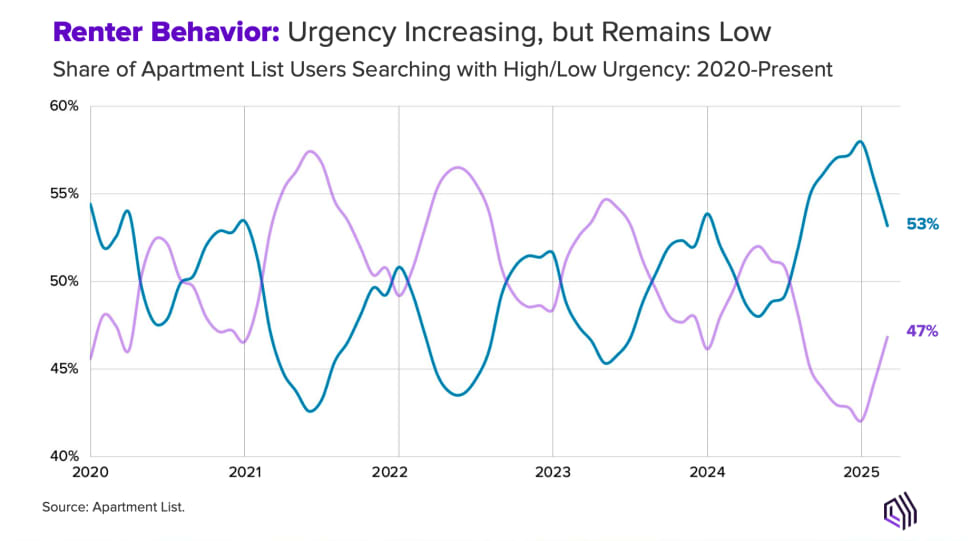

- Rising but restrained urgency: 53% of Apartment List users now report high urgency in their searches, an improvement from winter lows but still below typical spring levels.

- Extended decision timelines: The median time-on-market holds steady at 34 days, indicating that even well-positioned units face longer leasing cycles than historical norms.

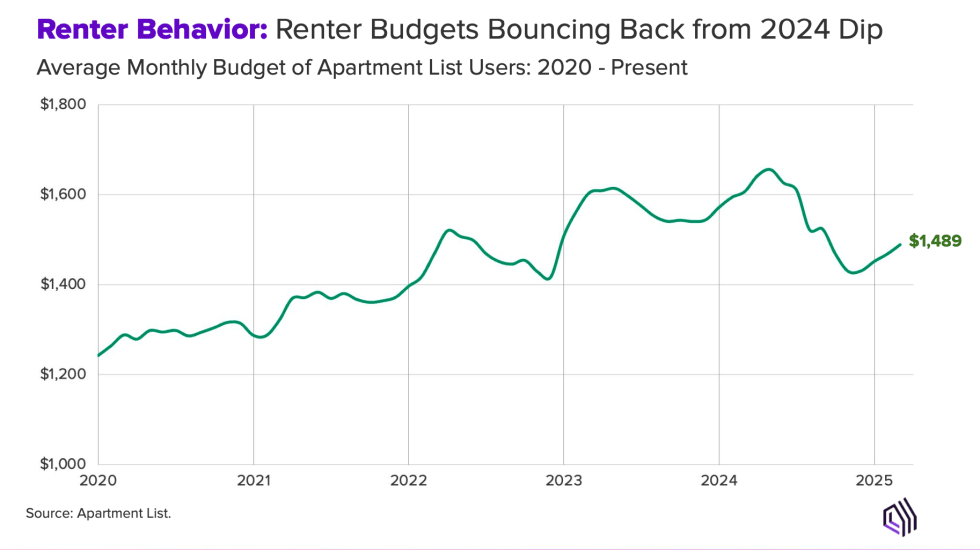

- Recovering budgets: After belt-tightening in 2024, renter budgets are rebounding, with the average user now targeting $1,489 monthly rent, a positive signal for premium properties.

What emerges is a portrait of renters who are actively searching but taking their time, comparing options meticulously, and demanding clear value propositions before committing.

Leasing Playbook: Success this season requires more than competitive pricing, it demands strategic positioning that addresses the deliberate nature of today's rental searches. Properties that streamline the application process, offer flexibility on move-in dates, and clearly articulate their value proposition will convert prospects more effectively than those relying solely on price adjustments or standard concessions.

Migration Dynamics: Sustained But Evolving Patterns

Population shifts continue to reshape rental demand across markets, with important implications for property managers:

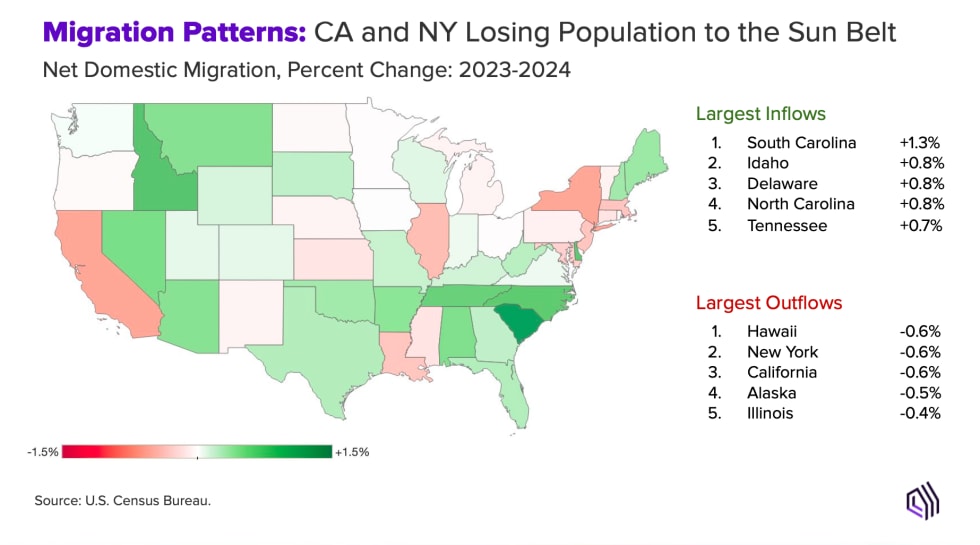

- Sun Belt momentum persists: South Carolina (+1.3%), Idaho (+0.8%), North Carolina (+0.8%), and Tennessee (+0.7%) are the states that grew the fastest last year from domestic migration, reinforcing the long-term shift toward these regions.

- Continued exodus from high-cost states: California, New York, and Illinois maintain their status as top outbound migration states, though at a somewhat moderated pace.

- Regional moves outpacing long-distance relocation: The data shows a relative decline in longer-distance moves compared to pandemic peaks, with more renters now relocating within their home metropolitan area instead of moving to a new one.

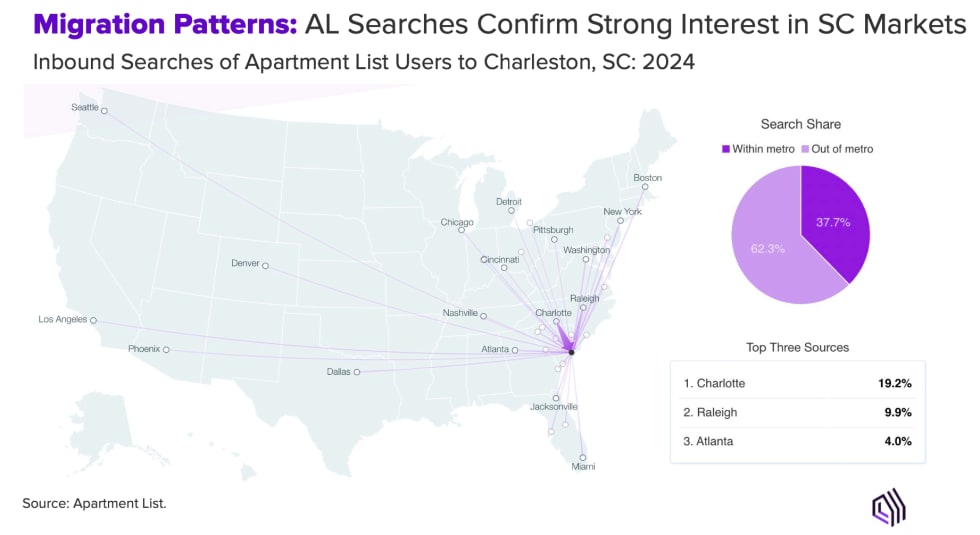

Charleston, South Carolina emerged as a particularly strong performer in our search data, exemplifying how mid-sized markets with strong quality-of-life factors continue to attract relocating renters.

Market Moves: Markets benefiting from migration inflows face a complex dynamic where long-term demand indicators remain strong, but near-term rent performance may still be constrained by elevated inventory. Operators in these markets should focus on retention strategies for existing tenants while positioning to capture the sustained migration flows with targeted marketing that highlights lifestyle benefits for newcomers.

Construction Pipeline: The Supply Wave Begins to Recede

With over 750,000 multifamily units still under construction nationally, supply pressures won't disappear overnight. However, we're seeing clear evidence that the development pipeline is finally tapering:

- New multifamily starts have declined substantially.

- Financing constraints continue to limit new project announcements.

- The delivery timeline for current projects suggests peak supply impacts may soon be behind us.

Property Pro Tip: While 2025 will continue to see significant new inventory hit many markets, the declining pipeline suggests that supply-demand fundamentals could begin normalizing later this year and into 2026. Operators should focus on weathering the current competitive environment while positioning for the improved conditions that appear increasingly likely in the coming quarters.

Outlook: Positioning for the Next Phase

As we assess the landscape heading into summer, the rental market appears to be entering a transition phase. While not yet a full-fledged recovery, multiple indicators suggest we're moving toward more balanced conditions:

- Month-over-month rent growth has turned positive across most markets.

- Annual growth metrics are steadily improving and approaching neutral territory.

- Renter budgets are recovering, supporting gradual rent normalization.

Barring macroeconomic disruptions, Apartment List anticipates that the remainder of 2025 will bring a steady, if not dramatic, improvement in market fundamentals. The pandemic-era boom and subsequent correction appear to be giving way to a more sustainable equilibrium.

Bottom Line for Your Business: Success in this transitional period requires balancing occupancy preservation with thoughtful revenue management. Operators should resist the urge for aggressive rent pushes that could jeopardize occupancy, while simultaneously identifying segments where recovering demand can support measured rent optimization.

Leasing Has Changed. Your Approach Should Too

As the rental landscape evolves, so must your toolkit for navigating these complex market conditions. Property operators need solutions that deliver measurable results while adapting to today's selective, deliberate renters.

Apartment List's unified platform brings together performance-based solutions that align perfectly with the challenges identified above:

- Convert more leads when it matters through our AI leasing assistant that engages prospects 24/7, critical when 53% of nurturing happens after hours.

- Maximize marketing ROI with a performance-based marketplace where you pay only for signed leases, not just leads.

The dynamics we've explored in this webinar, from cautious renter behavior to market-specific rent trends, require a more sophisticated approach to leasing. With Apartment List as your partner, you can navigate this transitional market with confidence. Ready to put these insights to work? Connect with us to learn how one platform can simplify your operations while driving better results.

Share this Article