What Is Proof of Income? 16 Ways to Show It

What Is Proof of Income?

Research shows that more than 5 million households are behind on their rent. Before they let someone sign a lease, landlords and property managers want to know whether they can afford to pay rent. Enter proof of income requirements.

Proof of income is one or more documents that a prospective tenant provides to a landlord or property manager to verify their ability to afford their monthly rent and associated costs. It's become a standard part of the apartment application process.

Showing proof of income for an apartment is crucial, though it can also be challenging to know how to start or what you'll need. Time is of the essence when you live in competitive cities with low rental inventory. Don’t worry. We did all the work for you, so you have everything you need to know about apartment income requirements, including 16 ways to show proof of income for rental application purposes.

How to Show Proof of Income

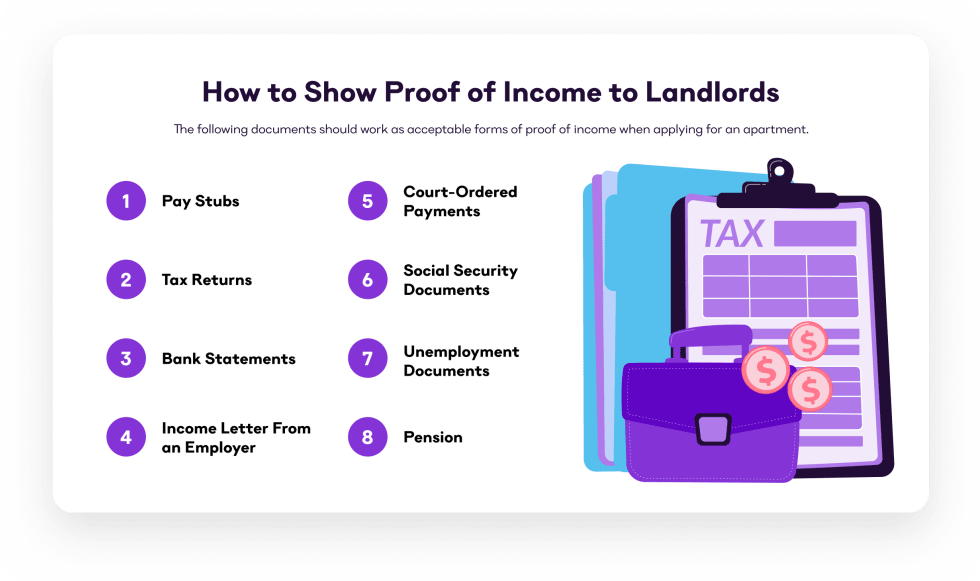

1. Pay Stubs

You should receive pay stubs at the end of each pay period that should detail your hourly rate or salary and how often you work. Your pay stub may also verify other details in the tenant screening process, like who employs you.

2. Tax Returns

Tax form 1040 details all the sources of income that you've earned over the tax year. Landlords usually want more than a tax form because it only proves your income from the previous year. Your landlord will still need to verify your current job and salary status to ensure an accurate report.

3. Bank Statements

Using bank statements as proof of income for renting is common for the self-employed and those with side hustles in addition to their day job. Without a traditional source of income, landlords need a better idea of how much you really earn. Remember that a bank statement only details the amount of money you deposit in the account and the amount coming out.

4. Income Letter From an Employer

Your employer will provide a proof-of-income letter that says how much you make. If you're new to your job and haven't collected a paycheck, you'll need a proof of income letter. Even after providing the documentation, your landlord may still want a copy of your pay stub when you receive it.

5. Court-Ordered Payments

Alimony payments, settlement fees, and child support are considered forms of regular income. The court will provide you with a letter detailing the agreements. If you don't have one, speak to your lawyer or call your local courthouse to track one down.

6. Social Security Documents

If you receive social security income, you can submit it as proof of income to your landlord or property manager. You'll need a letter or other documentation that details your monthly benefits. If you don’t have one handy, you can also request one online here.

7. Unemployment Documents

Unemployment assistance from getting laid off is also part of your verifiable income. But, of course, there are caps on unemployment benefits. Contact the unemployment office in your county to ask for an unemployment compensation letter.

8. Pension

You can also prove your income with your regular pension statements. Landlords will probably ask for a tax form 1099-R to help verify your annual pension distribution income. It’s also wise to have a bank statement showing your pension was deposited to your account.

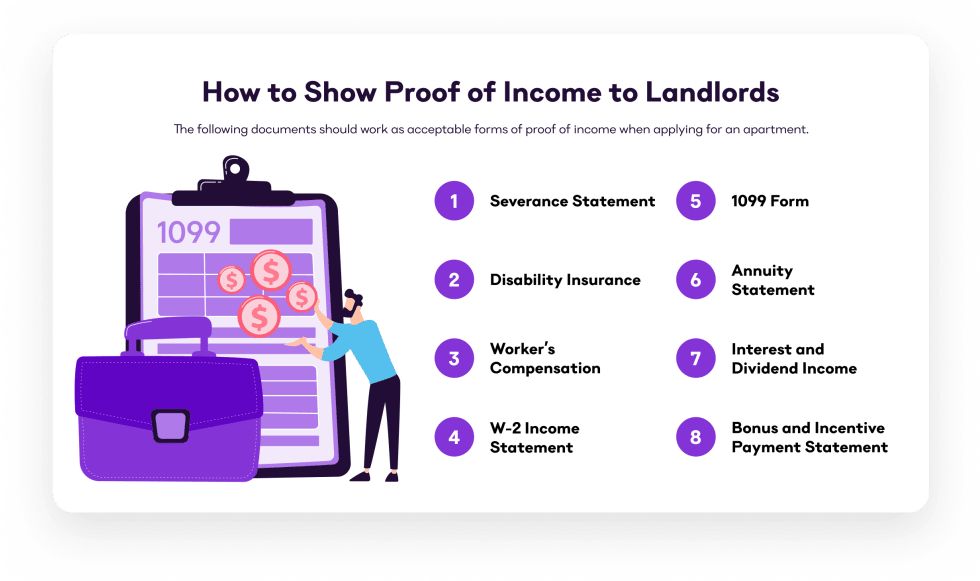

9. Severance Statement

Getting laid off or leaving your job isn't always a deal breaker for landlords. Depending on your job, you may have received a generous severance package to serve as your income. Their severance statement shows how much the company pays you. Ask your employer to provide the document.

10. Disability Insurance

If you’re wondering how to verify income without a current job, don’t worry. Although disability insurance benefits are not classified as income for tax-reporting purposes, they are still meant to replace income. For that reason, you can use disability insurance benefits for your proof of income documents.

11. Workers’ Compensation

Getting injured on the job may lead to a workers’ comp claim that serves as part of your income. In some cases, it may replace your income entirely. Submit your evidence of income with a letter from the court or an insurance company.

12. W-2 Income Statement

A W-2 statement is used for tax purposes, but it also provides valuable information about your annual earnings. If you have multiple employers, your landlord may want to see a W-2 from each. They may ask to cross-reference your W-2 with a pay stub or documentation from your employer.

13. 1099 Form

If you earned over $400 in self-employment income, you should have received a 1099 form. It lists all your income over the past year and details how much tax you pay on that income. You may need to ask those employers for a 1099 form or some kind of documentation verifying you worked with that company.

14. Annuity Statement

Do you receive a regular annuity statement that beefs up your income? An annuity statement helps a landlord understand how much you receive from an agreement with an insurance company. These statements show the amount you earn and indicate a payout schedule from the insurance company.

15. Interest and Dividend Income

If you’re an entrepreneur with investments, you can also provide documentation regarding your dividends and interest payments. Your landlord may also ask for your 1040 to verify they were reported and check other areas of your income. You’ll probably also be asked to show bank statements to prove your financial stability, specifically if you’ve ever dealt with sporadic income or an eviction.

16. Bonus and Incentive Payment Statement

Bonus and incentive payments can be a significant portion of your income. If income requirements for apartments are above your base pay, include any bonus or incentive pay statements in your apartment income verification process. Remember to keep a bank statement on hand that shows a history of your bonuses and incentives deposited into your account.

How to Know if You Can Afford Rent on Your Income

Knowing how to show proof of income is only step one of the process, as you also need to afford your rent comfortably. Apartment List's rent calculator is a valuable tool that'll help you calculate the amount you can comfortably afford for monthly rent payments.

The rule of thumb is not to spend more than 30% of your monthly income on rent. Your household income should also be two to three times your monthly rent. For example, if your rent is $1,000 per month, your landlord will want you to earn around $3,000 per month to afford your rent comfortably. However, if you live in an expensive area like New York City, it's common for new renters to pay much more.

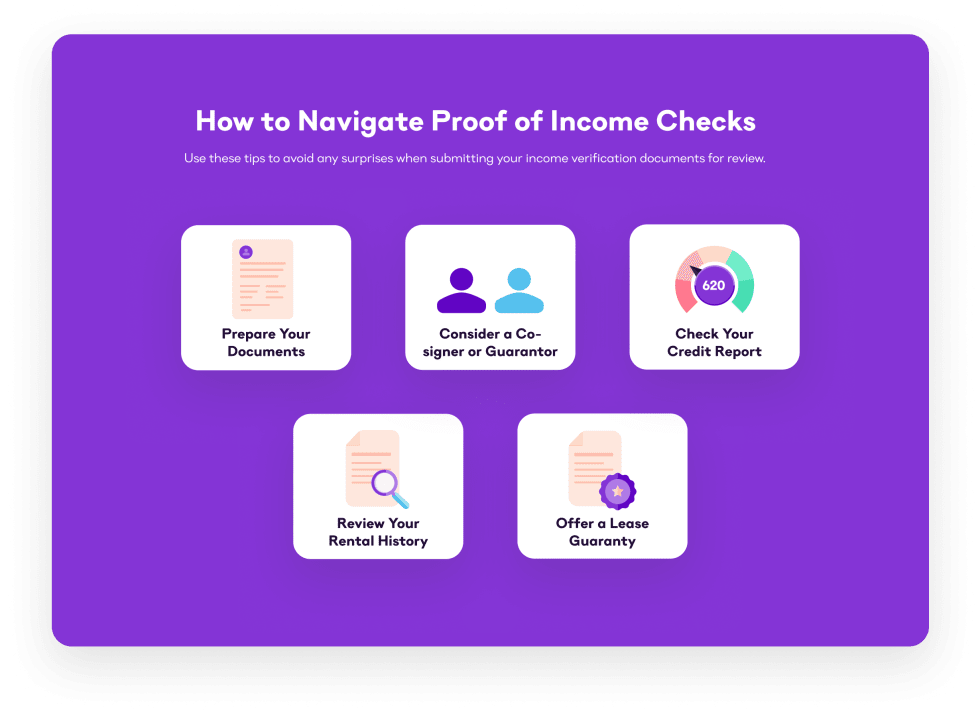

5 Tips for Meeting Proof of Income Requirements

As you now know, there are several examples of proof of income. Additionally, the following are some tips for regarding apartment rental income requirements and understanding what qualifies as proof of income.

- Prepare your forms and documents. Come organized to an apartment tour or lease signing with your tax forms, proof of income, bank statements, and anything else that proves your income.

- Consider a co-signer or guarantor. If you have nonexistent or poor credit, you should consider asking a family member if they would step in as a co-signer or a guarantor.

- Check your credit report. Check your credit report in advance and explain how you overcame anything problematic to your landlord.

- Review your rental history. Make a list of your previous rentals and ask for landlord references in advance. If you haven't yet, consider rent reporting services so that your on-time rent payments appear on your credit history.

- Offer a lease guarantee. If you have a problematic rental or financial past, offer a lease guarantee with a higher security deposit.

If you have a problematic financial or rental history, you need to come as prepared as possible. Your organization, documentation, and explanation of any issues will go a long way to win over a landlord or property manager.

Make Your Move: Start Apartment Hunting

Now that you have everything you need to show proof of income for your apartment, it’s time to start your apartment hunt. If you’re worried about your finances, consider a short-term apartment or a for-rent-by-owner apartment. There’s always a way to find an apartment that works for you, regardless of your past finances or proof of income track record.

Ready to find the perfect place for you? Sign up for Apartment List to find your next apartment. With us, you’ll spend 5 minutes and save 50 hours searching.

Proof of Income FAQs

What Is Verifiable Income?

Verifiable monthly income for apartment application purposes verifies that you already have a reliable income source, allowing you to comfortably pay for your rent. Your landlord or property manager will require documentation to support the income listed on your apartment application.

How Can I Show Proof of Income Without a Pay Stub?

There are plenty of proof of income examples aside from a pay stub, including tax returns, bank statements, income letters, court-ordered payments, social security documents, unemployment documents, pension, severance statements, disability insurance statements, worker’s compensation, W-2 income statements, 1099 forms, annuity statements, interest and dividend income statements, and bonus and incentive payment statements.

What Is a Proof of Income Letter?

A proof of income letter is an official document from an employer verifying your income. This letter will state that you are currently employed at a specific company and provide your salary information. To acquire a proof of income letter, you will need to speak with your employer directly.

What Should a Proof of Income Letter Say?

A proof of income document should state your income details such as your salary or hourly rate. Additionally, a proof of income letter should include your name, job title, phone number, email address, name of your employer, employer’s phone number, employer’s email address.

Share this Article