South Bank at Quarry Trails

- 91 units available

- Studio • 1 bed • 2 bed • 3 bed

- Amenities

In unit laundry, Patio / balcony, Granite counters, Pet friendly, Stainless steel, Walk in closets + more

A rent-to-own contract is a rental agreement that gives you an opportunity to purchase the home you’re living in once your lease is up. For renters who want to buy a property, but aren’t quite ready for a mortgage, rent-to-own can be a stepping stone toward homeownership. It’s especially appealing if saving for a down payment feels impossible or your credit score needs time to improve.

So, how exactly does rent-to-own work? And is it a smart financial move? We’ll walk you through all the details, including how contracts are structured, the pros and cons, and some best practices before you sign.

A rent-to-own lease lets part of your monthly rent count toward buying the property at the end of your lease term. In a standard rental, 100% of your payment goes to your landlord. With rent-to-own, a portion gets set aside as a credit toward your future down payment or purchase price.

In some rent-to-own contracts, renters also pay what’s called an option fee upfront—usually 1% to 5% of the home’s value. This nonrefundable fee secures your right to buy the property later. Not every contract requires it, but if you skip the purchase at the end of your lease, you’ll likely lose whatever option fee you paid.

In most cases, a rent-to-own agreement starts with a lease that runs for one to three years. The renter usually pays a nonrefundable option fee upfront—often 1% to 5% of the home’s value—which counts toward the eventual down payment.

From there, the renter moves in and pays monthly rent that’s slightly higher than a standard lease. That extra amount is credited toward the purchase price, helping build up the down payment over time. One of the biggest draws of rent-to-own is that the purchase price of the home is locked in at the start of the contract. When the lease ends, the renter has the opportunity to buy the property at that pre-agreed price, regardless of how the market has shifted.

While rent-to-own contracts follow the same principles, there are two primary types of these contracts you may run into: a lease-option or a lease-purchase agreement.

With a lease-option agreement, the renter pays the option fee at signing. One major benefit of a lease-option agreement is that the renter typically has more negotiating power regarding the amount of the option fee.

Throughout the lease, renters can pay rent credits or additional payments towards the down payment of purchasing the home. At the end of the lease, the renter has the option—not the obligation—to buy the home.

In a lease-purchase agreement, the renter commits to buying the home at the end of the lease, with a portion of the monthly rent going towards the purchase price.

This agreement does carry more risk, but if you’re confident you want the property, it can feel like a solid savings plan toward ownership.

If you’re trying to decide between a lease option or a lease-purchase agreement, pay close attention to the current market.

Paying for an appraisal at the end of the lease may be better if home prices are relatively stagnant. But, if housing prices continue to rise, locking in a rate ahead of time is probably the best move.

Finding rent-to-own leases is a bit trickier than looking for a house or an apartment. You can start with listing sites like Zillow, as Ben Sund explains in the video below. Our tip? Consult with a trusted agent or real estate attorney. It’s often worth the extra step.

Check out these great insights on the different ways you can find listings for rent-to-own leases:

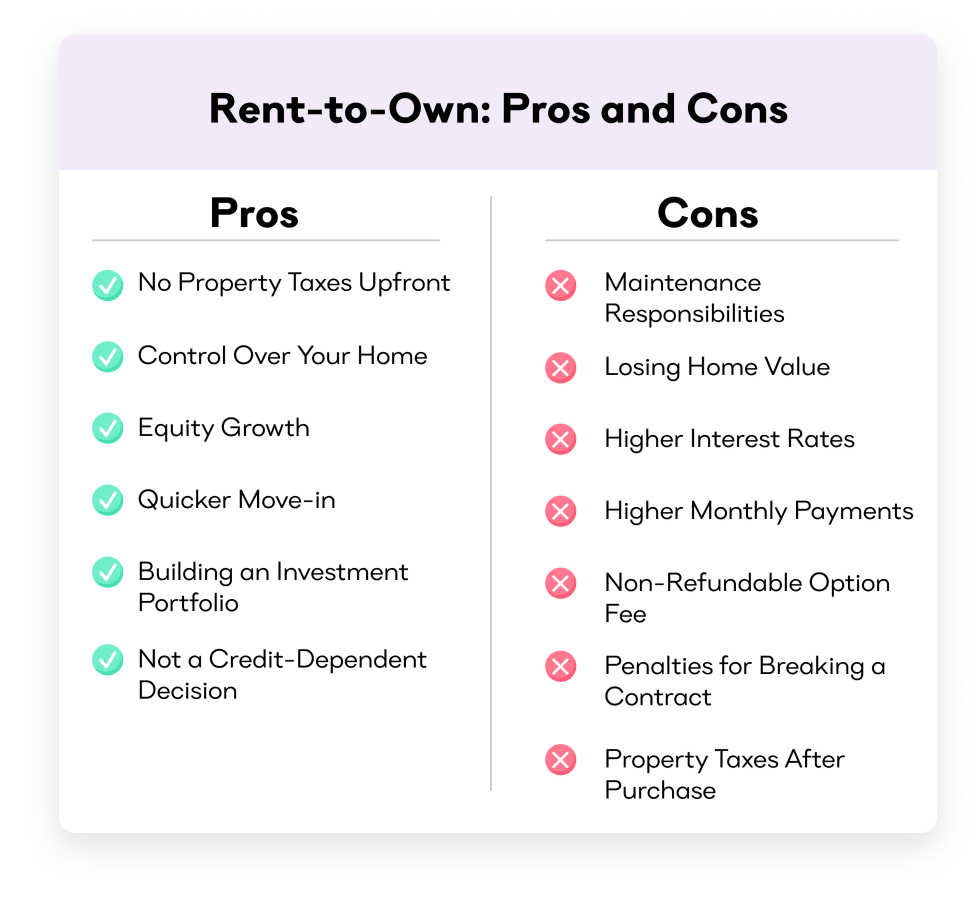

Like most major housing decisions, rent-to-own contracts come with pros and cons. Let’s look at both sides to help you decide if rent-to-own is the right move for you.

One of the major benefits of entering a rent-to-own contract is the ability to save up for a down payment while building credit and home equity simultaneously. Here are some of the other significant pros of renting to own:

| Rent-to-Own Pro | Why It’s a Win |

|---|---|

| No property taxes (yet) | Landlords are responsible for property taxes while you rent. |

| Feels like ownership | Once you move in as a renter, the home is essentially yours. |

| Grow your equity | A portion of payments goes toward your future home. |

| Move in faster | You can move in within one to two weeks after signing the contract. |

| Not a credit-dependent decision | Many landlords focus on your payment history during the lease instead. |

| It’s a smart investment | Instead of rent going to your landlord, your money goes toward purchasing your future home. |

In addition to the benefits of rent-to-own contracts, there are some downsides. Here are the most common to consider:

| Rent-to-Own Con | Why It’s a Drawback |

|---|---|

| After-purchase property taxes | Renters will take on property taxes before eligibility for tax breaks. |

| Maintenance responsibilities | Renters may be responsible for maintenance costs during their lease. |

| Potential of lost home value | The home's market value may drop after the rental period. |

| Penalties for breaking a contract | Some contracts may have financial penalties. |

| Non-refundable option fee | If you decide not to purchase at the end of your lease, you lose that money you paid upfront. |

| Higher interest rates | There may not be low-interest rates in rent-to-own contracts. |

| Higher monthly payments | Standard rentals will have lower monthly payments because additional funds aren’t going toward a down payment. |

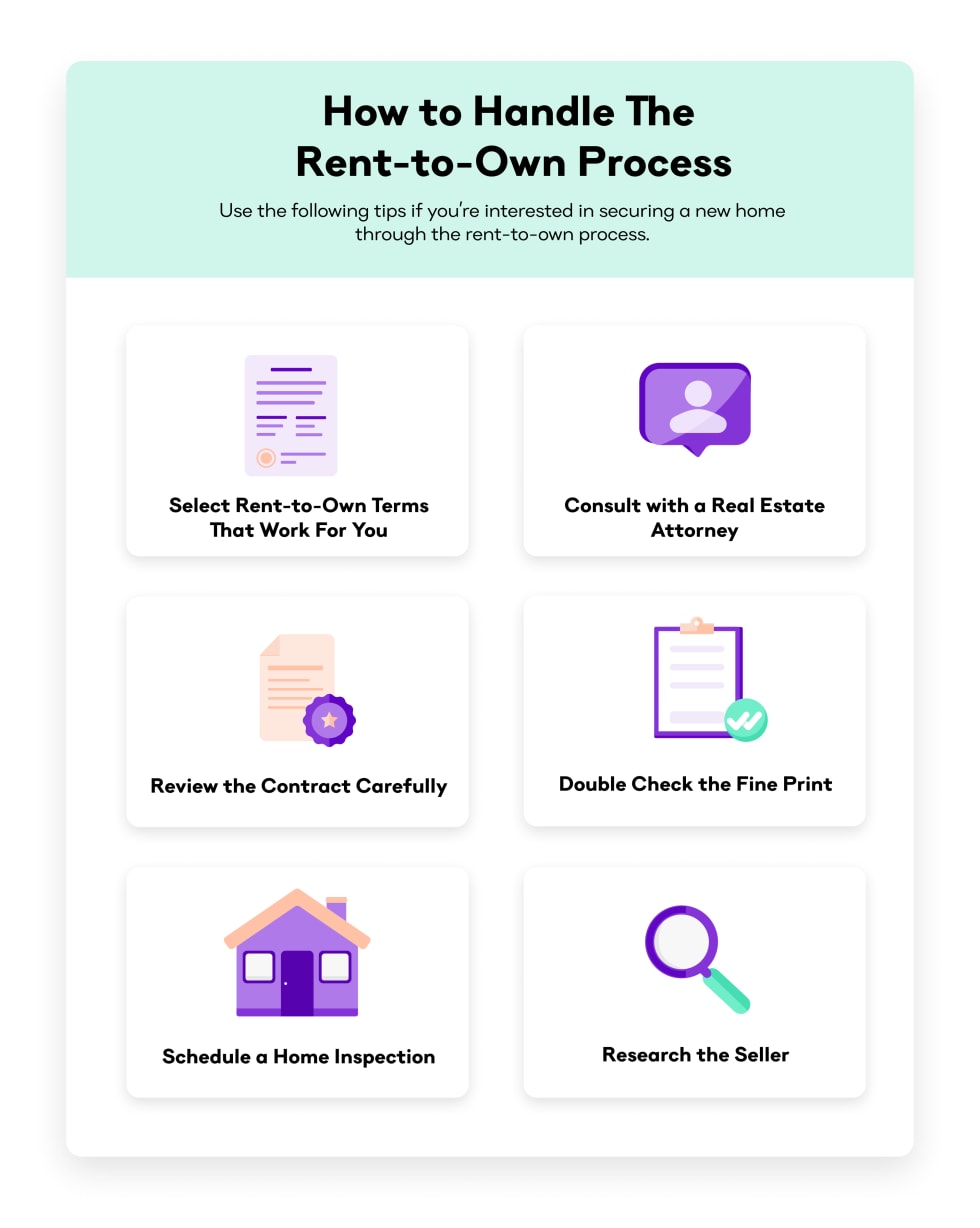

Before you sign a rent-to-own contract, here are a few tips to keep in mind and protect yourself:

Determine whether a lease purchase or lease option suits your current financial situation. Taking the time to assess if your finances can support your rental decision can only help you make a more confident decision.

If you’re unsure about the terms of a contract, you should always consult with a professional. A real estate attorney can help lead you in the right direction with your new contract.

Much like you would any legally binding document, review the contract thoroughly before signing.

Reviewing the contract includes double-checking the fine print to understand the details of essential factors such as rent payments and the option fee.

Scheduling a home inspection will ensure that you conduct proper research on the home before agreeing to a selling price.

Always do your due diligence by looking into the seller and their home. Always verify their contract information and the address of the listed property.

Rent-to-own can be a helpful path to homeownership if a traditional mortgage feels out of reach today. It lets you live in your potential future home while saving toward buying it, but it’s not without risks.

If you’re considering this option, remember: get all the facts upfront, seek out the right professional support, and read the fine print before you sign. That way, you’ll know whether rent-to-own is truly a stepping stone toward owning a home, or just a costly detour.

Rent-to-own lets you rent first, then decide if you want to buy, with some of your rent counting toward the purchase. A mortgage requires a full down payment and monthly payments from day one.

Rent-to-own can be a great option if you’re serious about investing in real estate. Before going into an agreement, understand the risks, fees, and market conditions. Locking in a purchase price early can be valuable, but you’ll want to make sure you’re not overpaying.

Owning a home is usually more expensive than renting. However, purchasing a home means growing equity, which may enhance your financial standing overall. Rent-to-own sits somewhere in the middle.

The option fee—aka the down payment of a home in a rent-to-own contract—is typically between 1% and 5% of the home value, and isn’t always required.

To calculate rent-to-own payments, review and understand the rates of the option fee, monthly rent, and home purchase price. If you’re unsure about the math from the leasing agent, consult a real estate attorney before you sign any contracts.

Not automatically. Most agreements don’t report to credit bureaus. But you can use third-party services to report rent payments and help boost your score.

Rent-to-own contracts are legal, but it’s essential to check out the legality of the details of your agreement based on local laws.

It depends on your rent-to-own contract type. Lease-options let you walk away (but you’ll lose your option fee). Lease-purchase agreements usually have penalties if you back out.

In unit laundry, Patio / balcony, Granite counters, Pet friendly, Stainless steel, Walk in closets + more

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more