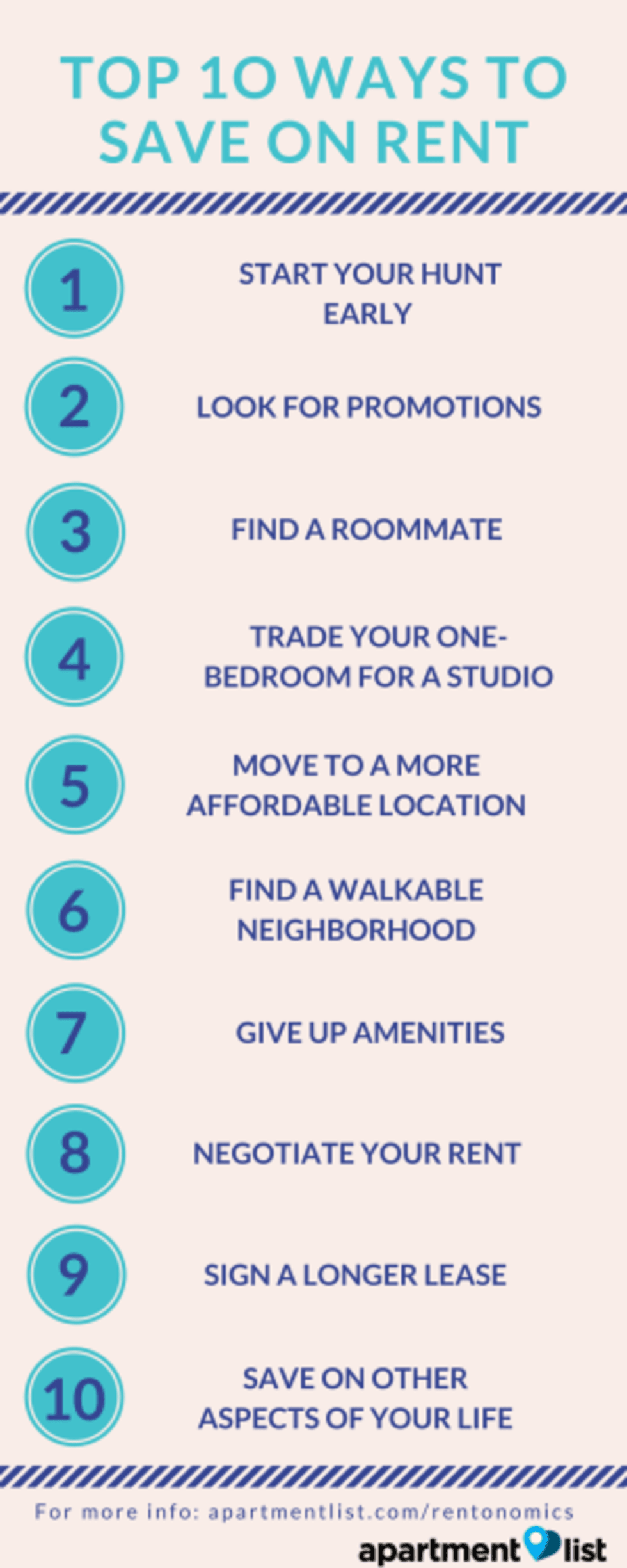

Top 10 Tips for Saving on Rent

Are you looking at your monthly expenses and thinking something has to go? Trying to save for a down payment? Pay off your student loans?

We’ve all been there. Housing is the largest annual expense for most renters so saving money on rent will have a huge impact on your overall budget.

Unlike saving money on a one-time purchase, like a flat screen TV, you’ll save every single month if you decrease your rent. Save thousands of dollars each year by following Apartment List’s top 10 tips for saving money on rent.

Moving to a new city? Lease about to expire? Make sure to start your apartment hunt a couple months in advance. Starting your search earlier allows you to compare prices and have a full range of options.

If you wait to sign a lease until the week before you have to move, the cheapest options may already be taken. Additionally, you’ll have time to explore new neighborhoods and potentially save by moving to a less expensive area.

Apartment owners and property management companies often offer promotions when they have a higher number of vacancies. Common promotions include lower or no security deposit, rent discounts and free parking. Some properties offer even more creative promotions. For example, one of our Denver properties offered new renters free tanning.

Apartment owners and property management companies often offer promotions when they have a higher number of vacancies. Common promotions include lower or no security deposit, rent discounts and free parking. Some properties offer even more creative promotions. For example, one of our Denver properties offered new renters free tanning.

Recent promotions on Apartment List include one month of free rent in Dallas and $1,500 off rent in Los Angeles. In Boston, one property offered no security deposit and three free months of parking. Promotions are a great way to save money without giving up anything on your wishlist.

** Getting a roommate can save about $1,000 a month in many cities, plus you’ll be able to split utility and grocery costs**. For example, in Boston you can save $1,150 per month on rent, or $13,800 per year, sharing a two-bedroom apartment with a roommate, rather than paying for a one-bedroom apartment by yourself. Even in more affordable cities, such as Atlanta and Charlotte, you can save about $5,000 a year by moving in with a roommate.

If you’re willing to sacrifice more of your personal space, consider sharing a bedroom to save thousands more. Not willing to share a room? Consider sharing a bathroom with your roommate. In New York City, you can save about $500 a month by getting an apartment with one bathroom instead of two bathrooms. That's one less bathroom to clean!

Not a fan of roommates? You can still save money by moving from a one-bedroom apartment to a studio. Your new studio might feel a little cozy, but having the place to yourself might be worth it. In Los Angeles, you can save about $2,500 per year living in a studio and you’ll only have to worry about your dirty dishes staring back at you.

As an added bonus, you won’t need as much furniture. Make some extra cash by selling off items you won’t need like your old desk, bookshelf or coffee table.

Rents vary widely by location, even within a city or metro. Consider moving to a neighboring suburb or a less expensive neighborhood. In Washington, D.C., you can save $7,800 per year on a two-bedroom by moving north on Connecticut Avenue from the neighborhood of Dupont Circle, where the median annual two-bedroom rent is $40,440, to Van Ness-Forest Hills, where the median two-bedroom rent is $32,640. You’re only a ten-minute metro ride away.

Rents vary widely by location, even within a city or metro. Consider moving to a neighboring suburb or a less expensive neighborhood. In Washington, D.C., you can save $7,800 per year on a two-bedroom by moving north on Connecticut Avenue from the neighborhood of Dupont Circle, where the median annual two-bedroom rent is $40,440, to Van Ness-Forest Hills, where the median two-bedroom rent is $32,640. You’re only a ten-minute metro ride away.

If you’re willing to extend your commute by half an hour, moving from Washington, D.C., to neighboring Silver Spring, Md. saves about $15,000 on a two-bedroom apartment each year. In Washington, D.C., the median rent for two-bedroom is $3,050 while in Silver Spring it’s $1,770.

Moving cities is a bigger change than most of the other tips on our list, but if you're willing to make a big leap you can save thousands of dollars a year. Thinking about changing careers? Moving back to your hometown? If you've been feeling restless and ready for a change, moving to a new city can provide the fresh start you need.

If you move to Seattle from San Francisco, you can save $20,520 per year. The median one-bedroom rent in Seattle is $1,690, compared to $3,400 in San Francisco. Leave Seattle for Austin -- where the median one-bedroom rent is $1,160 -- and save another $6,360 per year.

Say goodbye to all the expenses of owning a car by moving to a walkable neighborhood with good public transportation. Even if you’ve paid off your car loans, parking, registration and insurance can cost about $6,000 each year in cities such as San Francisco!

In comparison, a monthly public transportation pass in San Francisco costs $1,100 a year. I**f you have to pay a little more for your apartment to live near public transportation, you still could be saving thousands by eliminating car expenses.**

Yes, we all want a pool, gym, parking, in-unit laundry and balcony, but our wallets may say otherwise. Through our Apartment List search, we found that giving up your pool in Denver saves $400 a month on a two-bedroom. That’s enough for you and your roommate to spend a week soaking up the sun at a resort in Cabo, Mexico.

Willing to give up your gym in Indianapolis? Based on our scan of prices for apartments with gyms, you can save $80 a month and you won’t have to make up an excuse to get out of your workout. Plus, if you're already walking or biking to work you won’t even miss that gym membership.

Still really want that pool or gym to stay fit? Giving up a dishwasher and in-unit laundry is an easy way to save $100 a month in Denver or Indianapolis without sacrificing your summer bod.

If your lease is about to end, try negotiating your rent before moving to a less expensive place. You’ll save on moving costs, and you may end up paying less for the same apartment. You can also try negotiating for free amenities such as a parking spot or gym membership.

Watch for promotions where you live and consider asking for a similar promotion for re-signing your lease. Lease negotiations are most successful towards the end of the month and during winter when landlords are more desperate for tenants. Make sure to read these tips before negotiating your rent.

Do you live in a city where rents are rising, such as Reno, Seattle or Salt Lake City? Consider signing a longer lease so that you won’t have to deal with rent increases. By signing an 18-month or 24-month lease, you’ll be able to keep your rent constant for longer.

In Reno, rents have increased 9.2 percent year-over-year. By signing a two-year lease on a one-bedroom apartment, when the median monthly rent was $900, you could save about $1,000 in the second year. Some landlords will even offer discounts for signing a longer lease because it saves them the expense and hassle of finding new tenants as great as you!

Really don’t want to give up on that beautiful luxury apartment in the heart of Boston? Don’t lose all hope. You can save on other aspects of your life to pay for your rent.

Save $1,200 a year on utilities by giving up cable and a few more bucks on electricity by unplugging appliances and turning lights off. Bringing your lunch to work instead of buying a sandwich at your local shop could save $1,500 year! Save even more money by brewing your own coffee, making your own avocado toast, and enjoying a glass (or bottle) or wine at home instead of at a pricey bar. You can even make a few hundred bucks by selling clothes and books you no longer need.

Trade-offs are the name of the game when it comes to saving on rent. Want a top-notch luxury apartment? Consider moving to a new neighborhood or city to save money while living in style. Don’t want to part with your favorite neighborhood and short commute? Find a roommate and give up amenities to make it work. Now that you’re equipped with our best money saving tips, it’s time to start your search!

What’s worked for you? Share your best tip for saving money on rent and share with us @ApartmentList!

Share this Article