The Pembroke

- 118 units available

- 1 bed • 2 bed

- Amenities

In unit laundry, Granite counters, Hardwood floors, Dishwasher, Pet friendly, 24hr maintenance + more

Your rental history describes how you've acted in the past as a tenant, and it's an important part of your rental application. Factors like whether you paid rent on time, whether you were evicted, and other notes on your record help determine whether you'll be approved. Landlords will typically request your rental history when apply to rent an apartment. However, knowing more about your rental history before meeting with your landlord can be beneficial.

If you’re unsure how to check your rental history, you’ve come to the right place. Continue reading to learn more! Like to learn by watching? Check out this great demo from RentPrep, which shows you how a real phone inquiry might play out:

A rental history report provides details about a person's past behavior as a renter such as eviction, on-time rent payments, and credit history. It is typically used by landlords to evaluate potential tenants and decide whether to lease a property to them.

Often, a private consumer reporting company will compile a rental history report and include a detailed description of how you act as a renter. Other times, landlords will investigate your renter history individually by reaching out to past landlords. However it's done, the purpose of checking rental history is to inform landlords about how often you stay in one place, whether you pay rent on time, and in general clarify whether you'll be a reliable and safe tenant.

Rental history reports will typically include the following information:

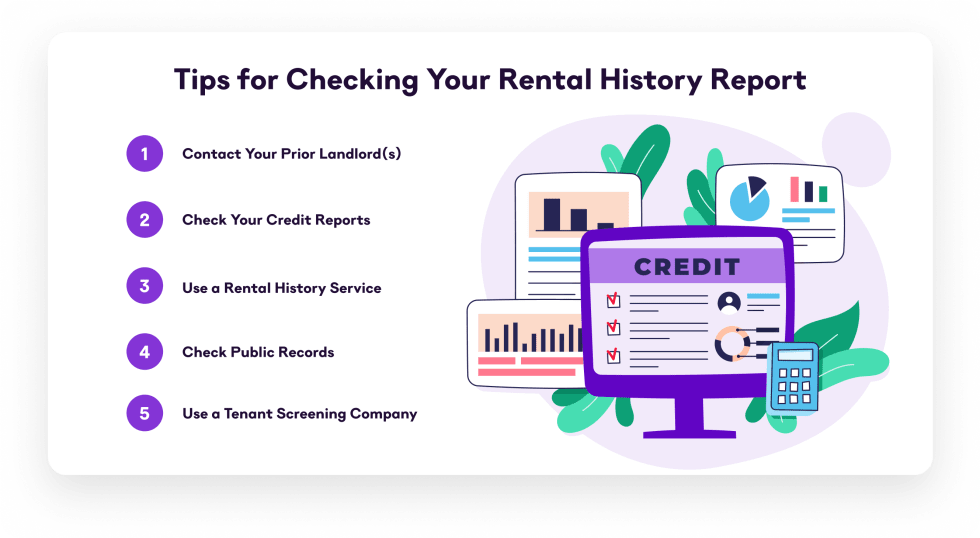

Checking your rental history report is an important step in understanding your rental background and ensuring that it accurately reflects you as a renter. It gives you an opportunity to ensure all the information on your rental history search is correct, including the addresses, dates of occupancy, and landlord name and contact information.

If you find any mistakes, you can contact the tenant screening or credit reporting company to dispute the information and have it corrected.

Landlords consider different things when choosing a service, including their budget, property type, desired level of detail in reports, and individual preferences, but here are a few popular option:

Choosing the right self-screening service depends on your specific needs and situation. Here's a breakdown to help you decide:

| Service | Pros | Cons |

|---|---|---|

| TransUnion SmartMove | Credit, rental history, criminal background, income insights | Higher cost |

| First Advantage | Credit, rental history, criminal background, income insights, good for first time users, great customer service | Higher cost |

| RentPrep | Eviction history, credit scores, affordability | Limited reporting features |

| E-Renter | Eviction history and late payments | Limited reporting features |

One fast and easy way to check your rental history report is by obtaining a copy of the report from a tenant screening company (like one of the ones listed above). These companies combine all of the major elements of a tenant screening. TransUnion offers one through their SmartMove program.

If you don't want to use a credit screening service, you can follow the same procedure that a landlord might use to gather screening documents individually.

Contact previous landlords directly to ensure you are both aware of (and in agreement about) your move out date, and also that you have a history as a tenant. You can also let them know to expect a call soon a prospective landlord.

If you know you've had an eviction, you can request records from CoreLogic, which is the primary agency for reporting evictions, and you can also request information from them as well. You can also use one of the third-party rental history reporting services listed below.

Obtain a copy of your credit report from one or all of the three major agencies (TransUnion, Equifax, and Experian). You can get a copy of your credit report for free.

You can request a copy of your criminal record if you have one from the locality or localities where you were charged for free. You can also use paid services like Intelius and ClearChecks to run the kind of background check a landlord might perform.

Now that you know how to check your rental history, you might be wondering, why do you need to know? There are a few reasons to make sure you're aware of what's in your rental history:

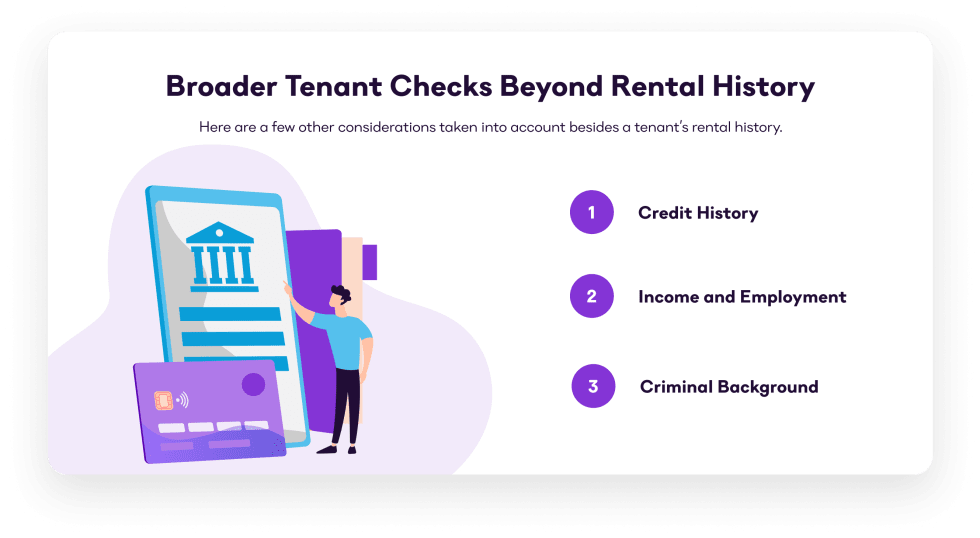

How do apartments check rental history? Well, beyond your history of rentals, on time payments, and any evictions, landlords will review a few other factors.

The first two factors a landlord is likely to consider are eviction history, and any history of missed rent payments. In addition to checking your credit history, a landlord in the process of running a rental history check is likely to make a phone call to your current landlord to ask directly about whether you're a good tenant who makes on time payments.

When a prospective landlords calls a current or previous landlord to inquire about your history, one thing they are likely to ask about is a history of complaints. Make sure that you are a good neighbor that does not disturb the quiet enjoyment of those around you to ensure you have no trouble renting again in the future.

Your prospective landlord likely wants to know that you can fulfill your obligation to pay rent, which will be a challenge if you are locked into more than one lease. Therefore, they will likely call your current landlord to verify a few pieces of information, including the end of your lease.

Beyond wanting to view rental history, landlords may also want information regarding your income and current state of employment. Since they want to ensure monthly on-time rental payments, they may reach out to your employer directly for confirmation.

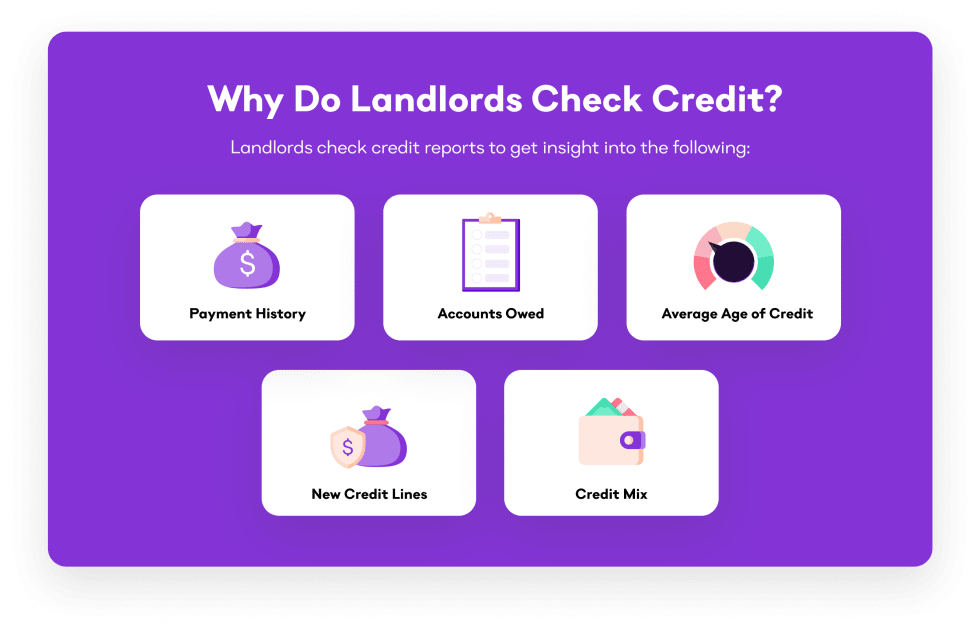

In addition to your rental payment history, a prospective landlord may be interested in your credit report to see how financially responsible you are. Credit history can be beneficial if you have no rental history whatsoever.

Furthermore, you should be aware that you can use rent reporting services to ensure that on-time rent payments appear in your credit history. Sometimes these services are even available free or at a reduced rate directly through your landlord.

Your criminal background may also affect your ability to rent an apartment. Any outstanding warrants, pending cases, or past misdemeanors/felonies that come up on your criminal background report may raise a red flag. Talk to prospective landlords ahead of time if you know one of these items might cause concern on your rental application.

Your rental history report paints a picture of your past as a tenant, influencing your chances of securing your dream apartment. While negative marks can make renting a challenge, don't despair! Here are some proactive steps you can take to improve your rental history report:

This is the single most crucial factor. Set up automatic payments or recurring reminders to avoid even minor late payments.

This typically involves filing a court petition to have the eviction sealed or erased from public records. However, not all states allow expungement of evictions, and specific eligibility criteria might apply. To learn more, check out our guide on renting with an eviction.

Address any maintenance issues promptly and discuss concerns respectfully. Maintaining a positive landlord relationship can benefit your report. Avoid unauthorized alterations, noise complaints, or lease violations. Respecting the property and community goes a long way.

It goes without saying, but take good care of the unit, reporting any damages promptly and leaving it clean at move-out. A responsible tenant leaves a positive impression.

Keep copies of rent receipts, maintenance requests, and communication with your landlord. This protects you and provides evidence of responsible behavior.

If you have past rental blemishes, be honest and proactive in explaining the situation to potential landlords. Demonstrating understanding and growth can make a difference.

If you're currently a responsible tenant, focus on maintaining that positive track record. Over time, positive behavior outweighs past issues.

Simply put, your rental history is your past experience as a renter, which can make or break your ability to rent an apartment. Thankfully, you can check your rental history online for free before prospective landlords verify the information and ensure nothing sits in the way of your new apartment!

Get started finding your new apartment today by checking out Apartment List's customized quiz.

Your credit report will show certain aspects of your rental history like missed payments, but you can use a rental reporting service to ensure that all of your on-time payments are forwarded to the three major credit reporting agencies.

You can rent an apartment with bad credit as long as you have a positive rental history to back it up. Let your prospective landlord know about any bad marks on your credit report before they find it on their own.

Making on time rental payments can help your credit, especially if you use a rental reporting service to ensure that all three major credit reporting agencies are notified whenever you make an on-time monthly payment.

A good rental history typically consists of a renter who consistently pays rent on time, does not cause property damage, has the income to support monthly rental payments, and has no past evictions.

Property managers look for a few things on your rental history report, including your consistency with making on-time rental payments, your eviction history, your criminal background, and red flags like a low credit score and a history of missed payments.

If you’ve never rented an apartment, you will not have a rental history report.

If you have a bad rental history report, start by ensuring that all information is correct. If it is, do your best to explain your circumstances to your prospective landlord before submitting your application. Secure referrals from other landlords who would provide you a positive recommendation. Demonstrate your ability to pay with proof of income and offer options like a short-term or month-to-month lease.

To ensure you have an excellent rental history report, always pay your rent (and any other fees due) on time, maintain open communication with your landlord during your occupancy, leave your unit in good condition, and always part on good terms.

In unit laundry, Granite counters, Hardwood floors, Dishwasher, Pet friendly, 24hr maintenance + more

In unit laundry, Hardwood floors, Dishwasher, 24hr maintenance, Stainless steel, Walk in closets + more