Renters Insurance: How to Get It (& When You Should) [2024]

If you're trying to figure out how to get renters insurance, you should know it's inexpensive, straightforward to get, and helps you manage financial risks. Some landlords require renters insurance, which protects both the rental business and the tenant. But even if it’s not a mandatory part of your lease agreement, it’s still a must-have for any renter.

If you’re thinking about protecting yourself, you’re in good company. Research shows that 55% of U.S. renters, or 61 million people, currently have renters insurance policies. We’ll dive into everything you need to know about how to find renters insurance and finding the best policy for you.

Navigating Renters Insurance

What Is Renters Insurance?

Renters insurance provides protection for individuals who lease their living spaces, much like homeowners insurance does for property owners. However, renters insurance does not provide coverage for the actual structure of the apartment or for any external structures. Instead, it covers the contents within the rented space (those that mainly belong to the renter).

This type of insurance tends to be relatively affordable, ensuring that a renter's possessions are safeguarded against specific dangers outlined in the policy. A real-life example of this would be if there was a flooding incident in your apartment due to a burst pipe. In such circumstances, your renters insurance policy might not only compensate for the damaged or lost items within your apartment but could also cover associated costs, such as hotel bills, if your residence becomes uninhabitable temporarily.

Who Should Get Renters Insurance?

There are certainly valid points to be made in favor of the argument that everyone should get renters insurance if possible. Renters aren't exempt from the kinds of crises that cause homeowners to purchase insurance, even though you're not responsible for the repairs to the building itself. In case of fire, flood, theft, or other disaster, everyone wants insurance coverage for their belongings and not just for the building. That's why you should opt for renters insurance.

If you lost all your belongings in a natural disaster, for instance, and needed financial help, renters insurance would ensure reimbursement for your lost property so that you could start picking up the pieces.

Is Renters Insurance Required?

It is increasingly popular for landlords to require renters to purchase insurance in order to protect their liability as well. So while not all landlords require renters insurance, you are likely to come across many that do, and in those cases, they will usually let you know how much coverage you need to purchase and offer suggestions for insurance agencies that they trust.

Interested in learning more about why renters insurance is sometimes required? Check out this helpful video from Think Insurance. It also has great tips on how to save on these policies:

What Does Renters Insurance Cover?

Here are some of the ways renters insurance protects you in an emergency.

Personal Property Coverage

The most basic renters insurance policy should cover your personal property against qualifying incidents, including theft, fire, water damage, and more. When you file a claim, you’ll receive some type of cash value or replacement cost. However, you'll pay a deductible and will be subject to coverage limits.

Liability Protection

Liability coverage protects your finances if you’re found legally responsible for someone getting injured at your apartment or incurring an injury. This type of renters insurance coverage could also help with potential lawsuits resulting from covered accidents and incidents in your rental.

Unforeseen Damages

Emergencies, accidents, and mishaps aren’t planned events, and they could lead to unforeseen damages. Your renters insurance covers perils including fire, theft, water damage, some natural disasters, accidents, and smoke. If you’re unclear about what the phrase “unforeseen damages” covers, talk to an insurance agent before purchasing your next policy.

Damage to Others' Property

If someone visits your apartment, and you accidentally break their phone or personal property, your renters insurance would come in handy. Many policies offer reimbursement for damage to others’ property, which could help you stay out of financial and legal trouble.

Peace of Mind

Beyond all the ways renters insurance protects you, it also provides peace of mind. You can rest easy knowing that, if something were to happen, you would have a Plan B that doesn’t include emptying your bank account. It can also prove helpful if you plan to live with a roommate or regularly host guests and want to ensure you’re protected in case of an accident.

How Much Is Renters Insurance?

According to Nerd Wallet, the average renter spends about $148 a year, or $12 a month, on renters insurance. The estimates assume a plan with $30,000 of personal property coverage and $100,000 of personal liability coverage, which is a common plan structure. Expect to pay more depending on how much coverage you need.

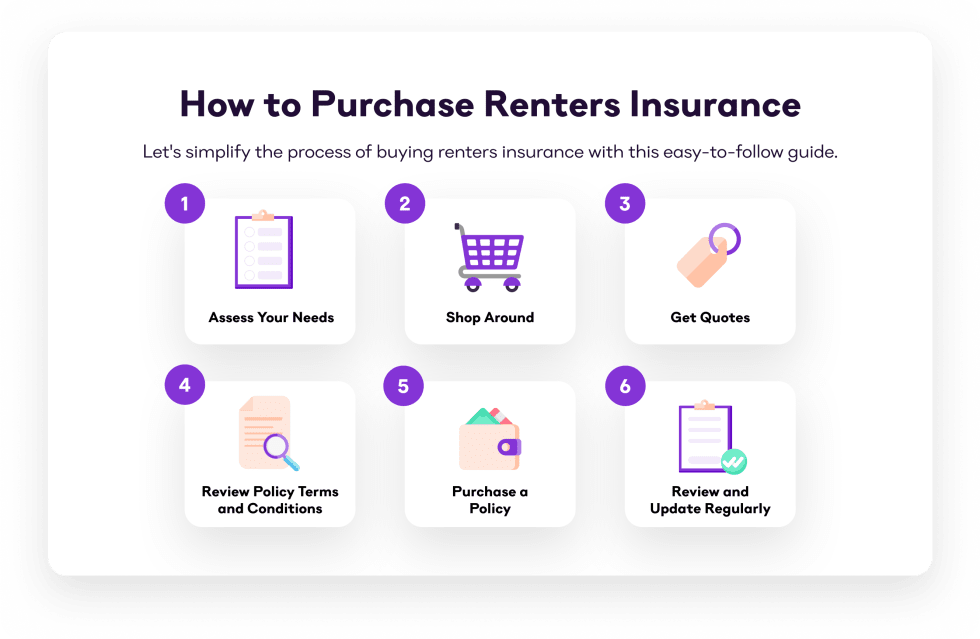

How to Get Renters Insurance for Your Next Apartment

If you’re sold on the idea of buying renters insurance, here’s how to find the right policy for you.

1. Assess Your Needs

Your landlord is legally required to have insurance on the apartment building, but it might only cover the structure itself and nothing relating to your dwelling. It may also offer little to no coverage for bodily injury or problems like the water that backed up and leaked all over your electronics. Ask for a copy of their policy to assess what type of coverage you need.

As we noted above, a typical policy offers $30,000 of personal property coverage and $100,000 of personal liability coverage. If the total value of your property is greater than $30,000, you should of course purchase more insurance.

2. Shop Around

There's no need to go with the first renters insurance policy you find. Shop for renters insurance by comparing different companies to see what's covered and what's not. It's also important to pay attention to your deductible and the value of your belongings. The more valuables you have, the more you'll probably pay for a good policy.

3. Get Quotes

Once you've looked at different renters insurance providers and policies, get a free renters insurance quote online or over the phone. An insurance agent can also provide a quote and help walk you through your options. However, if you want a low deductible, you'll pay a higher monthly premium, and vice versa. You can keep a high deductible if you don't have many valuables, but your monthly premium will be lower and could help your budget.

4. Review Policy Terms and Conditions

Once you receive your quotes and compare the deductibles against the monthly premiums, carefully review the policy terms and conditions. Make sure you know what your policy covers, from personal property to liability protection, covered perils, exclusions, and any limits to your coverage.

5. Purchase a Policy

When you're ready to buy renters insurance, it’s time to settle on how often you want to pay for it. You can usually choose to pay your premiums every month, once a quarter, every six months, or annually. Many providers offer a discount if you pay for your insurance six months to a year in advance.

6. Review and Update Regularly

Take time to review and update your renters insurance on a regular basis. How often should you shop around for renters insurance? Aim to review your policy at least once a year or just before it expires. You may be able to get a better deal on more comprehensive coverage from another company in the future.

Common Renters Insurance Mistakes

Getting renters insurance is a simple process, but it requires some diligence to avoid the following common mistakes. Otherwise, you could end up leaving your finances vulnerable.

Not Purchasing the Proper Amount of Insurance

Many renters fail to purchase the right amount of insurance, leaving themselves open to risk. Having a skimpy policy is almost as bad as having none at all. Here’s a good rule of thumb: If you have a total loss of belongings, make sure you can manage the financial fallout in case your insurance doesn't cover it.** **

Failing to Consider Additional Liability Coverage

When you get rental insurance, you usually start with the basics and explore additional coverage. You may need additional liability coverage beyond what's offered. For example, if you have a furry friend, you may benefit from pet liability coverage. Look through the additional coverage options available to ensure you have the protection you want for your unique needs.

Forgetting About Additional Coverages

When you purchase renters insurance, you should investigate all additional coverage and consider your unique needs. Do you live in a high-risk area for flooding or earthquakes? You may need additional coverage relating to natural disasters that are unique to your area.

Not Taking Advantage of Discounts

It's a smart move to ask about available discounts. You may find that bundling together auto insurance and renters insurance could reduce your overall premium. Some companies also offer nonsmokers discounts because it decreases the risk of fire-related accidents and damage.

Not Adding Your Landlord to Your Coverage

Adding your landlord to your coverage is the safest move for both parties. In fact, if you landlord requires renters insurance, there's a good chance they also require you to add them to your policy. Your insurance company will have a process specifically for adding a landlord to a renters policy (and it's often something you can do easily online).

Make Your Move: Start Apartment Hunting with Apartment List

Now that you know the ins and outs of how to get rental insurance, it’s time to start apartment hunting. If you live in a competitive rental market, landlords may consider you a more desirable tenant, and you could use your renters insurance to negotiate on rent. Mention it as part of your apartment hunt to set yourself apart from the competition.

Ready to find the perfect rental for you? Sign up with Apartment List and take our personalized quiz to find your next place. With us, you’ll spend 5 minutes and save 50 hours searching.

Renters Insurance FAQs

Do I Need Renters Insurance?

Sometimes renters insurance is a mandatory part of your lease. But even if it’s not, it’s a smart move to cover yourself completely and enjoy the peace of mind. Renters insurance can cover your belongings and protect your finances in a lawsuit if someone has an accident and damages their belongings or sustains an injury.

How Long Does It Take to Get Renters Insurance?

Getting renters insurance is fast and usually takes five minutes to a half-hour to get accepted. Most policies will take effect the next day but could take up to three days, depending on their underwriting guidelines. Buying renters insurance online is the fastest way to secure your policy.

Do You Need Renters Insurance Before Applying?

No, you don't need a policy before applying for an apartment. However, if a policy is required, you may need to purchase renters insurance after signing your lease before you're allowed to move in.

How Often Should I Shop Around for Renters Insurance?

It's a good idea to shop around for renters insurance once a year to see if you find a better deal with another company. You can usually switch providers pretty easily. You may be able to find a better deal by bundling your renters insurance with your auto insurance policy.

Does Renters Insurance Cover Flood Damage?

Flood damage from a natural disaster is often excluded from a standard renters insurance policy. However, it usually does cover flood-related losses if a pipe bursts in your apartment and consequently floods. Take the time to review your policy to ensure you understand what type of coverage your policy offers.

Does Renters Insurance Cover Earthquake Damage?

Earthquake insurance is usually offered as additional coverage on your renters insurance. It will increase your monthly premium and deductible, but it is vital if you live in an earthquake-prone area.

Does Renters Insurance Cover Vehicle Theft?

Buying renters insurance typically doesn’t cover vehicle theft. However, if your car is broken into while sitting in your apartment complex’s parking lot, your renters insurance may cover the theft of the personal belongings inside your car. You'll need a separate auto insurance policy to cover the actual theft of your car.

Share this Article