What Is a Guarantor & Do You Need One to Rent an Apartment?

In expensive cities with high rent prices, landlords may have steep demands from their applicants. In these places, a lease guarantor or co-signer can provide a bit more financial security for both parties.

If you want to learn more about how guarantors work for apartment leases, you’ve come to the right place. Let's dive in.

A Guide to Lease Guarantors

What Is a Guarantor?

A guarantor is someone who co-signs an apartment lease, accepting responsibility for paying a tenant’s rent and any other fees during a leasing period if the tenant cannot pay. Guarantors are usually parents, family members, or close friends who are willing and financially able to help you out if you can't cover your rent.

Why Would You Need a Guarantor?

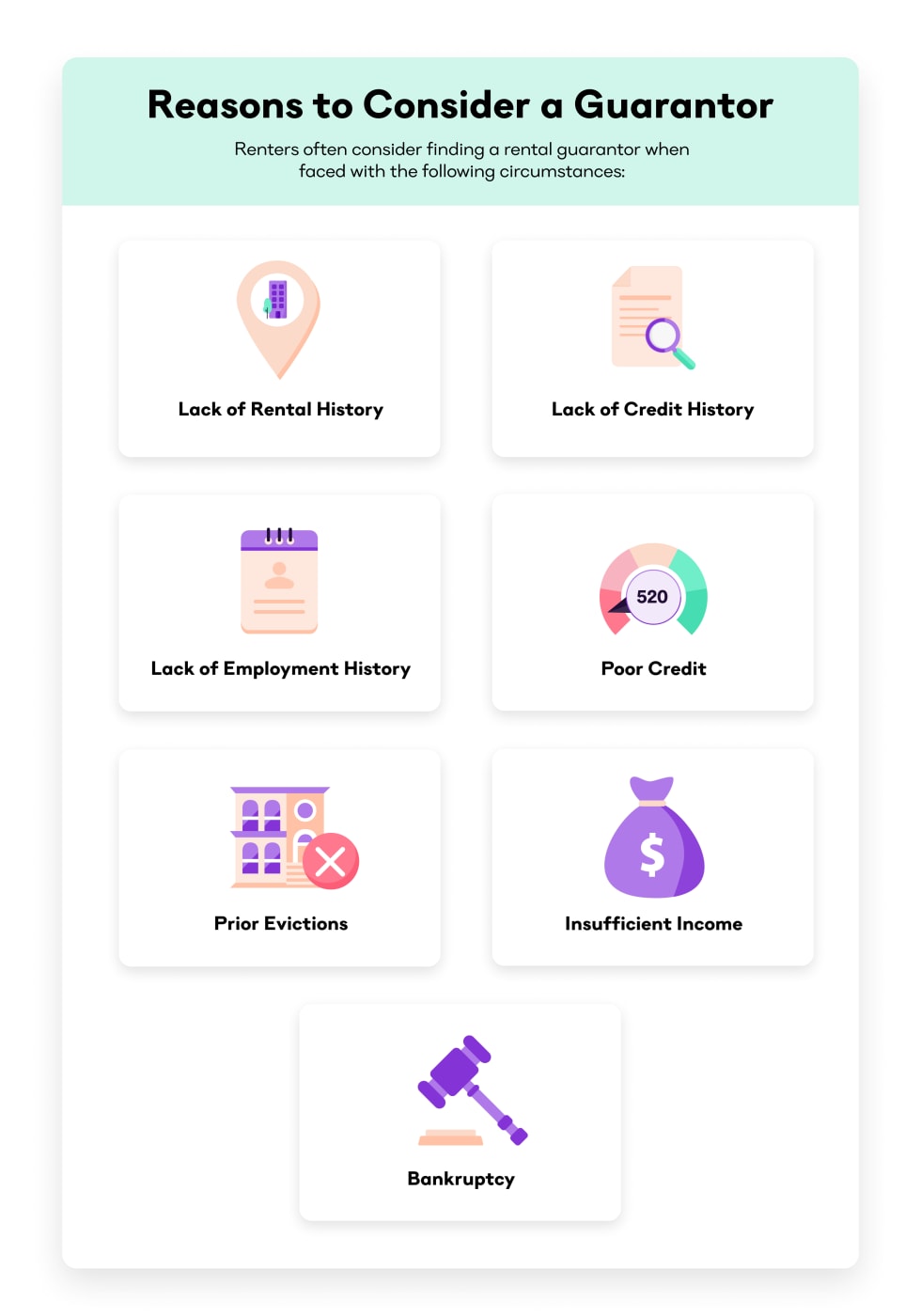

A guarantor is an added layer of security for a landlord if they're unsure about a prospective tenant. As a renter, here are a few reasons you may want a guarantor on a lease:

- You do not have a tenant referral

- You have poor credit

- You have a history of bankruptcy

- You have prior evictions

- You do not have an established income

- You just started a new job

- You are a student sharing a living space

- You have limited income that falls below the requirements

- You are renting for the first time

Finding a guarantor or co-signer can be helpful for renters. However, it’s important to understand the differences between the two.

Looking for more? Check out this great breakdown from Maverick Law Firm:

Lease Guarantors vs. Co-signers: What’s the Difference

Most landlords use terms like co-signers and guarantors interchangeably. Technically, however, a guarantor is responsible for stepping in and paying rent if it’s unpaid, while a co-signer may be added to the lease as another tenant with the right to occupy the property.

Depending on the city, your landlord may use different terms. For example, San Francisco typically calls any guarantor added to the lease a “co-signer,” but in New York City, landlords call this person the “guarantor” for an apartment.

Is It Better to Have a Co-Signer or Guarantor?

Because co-signers are considered additional tenants, they are legally responsible for rent throughout the length of the agreement. A guarantor is only responsible once the tenant has failed to pay rent on time. Moreover, a co-signer has the same rights to use the property as a tenant. Therefore, which one you choose will depend on your situation, and whether the person signing with you wishes to have the rights (and responsibilities) of a lessee.

Who Can Be a Guarantor?

Anyone can be a guarantor, but they are commonly parents or other family members or close friends. There are also lease guarantor companies you can work with, but be mindful of their requirements should you fail to make rent, and make sure they are well-reviewed, legitimate operations.

Here are some common characteristics of guarantors:

- Excellent credit history

- Proof of income

- Over 21 years of age

- Separate banking information from the tenant

- Annual salary 80x the monthly rent

What Does a Guarantor Need to Provide?

Most landlords make it clear what kind of financial guarantee they want from a lease, but just in case, make sure to read the lease's fine print. Here are a few of the common guarantor requirements:

- Social security number

- Bank statements

- Tax returns

- Pay stubs

Now that you have a basic understanding of guarantor requirements, let’s move on to finding a guarantor.

What Are the Risks of Being a Guarantor?

Being a guarantor means that you are taking financial responsibility for someone's rent payment should they be unable to pay it. A failure to meet that responsibility could mean damage to your credit or even having your assets seized.

If you agree to become a guarantor for someone, make sure you trust them, and make sure that you have the funds to cover their rent payments if they fall short.

How Long Does a Guarantor Stay on the Lease?

Typically, a guarantor will remain on the lease for the full length of the rental agreement.

How to Find a Guarantor

Guarantors usually aren’t casual acquaintances or younger friends at the beginning of their careers. Rather, they are family members, close friends, or understanding employers with good credit scores and hearts of gold to back your lease. When you're looking for a guarantor, choose someone you can trust who also has the ability to help you out if you face any financial setbacks.

- Close family members: Parents, siblings, or other close relatives are often the first choice due to existing trust and potential understanding.

- Established friends: Long-term friends with proven financial stability can be suitable options, but ensure strong communication and clear expectations.

- Professional references: In specific situations, a stable employer with a strong understanding of your work ethic and financial situation might be considered, but tread cautiously and discuss thoroughly with both parties.

When approaching potential guarantors, here's a few ways to make the conversation more successful:

- Be transparent: Explain the situation and the lease requirements for a guarantor.

- Express appreciation: Acknowledge the seriousness of the request and express your gratitude for their time and consideration.

- Be upfront about finances: Discuss your financial situation openly and explain why a guarantor is necessary.

Remember that a landlord will also likely ask for detailed information about your guarantor's finances, credit history, and willingness to step up and pay rent if necessary. Therefore, everyone must be comfortable with the arrangement.

Looking to Move Soon?

Ready to move to the city of your dreams but need an apartment lease guarantor? Do your legwork early and use Apartment List to find properties accepting guarantors. Then, make sure to build good faith with your friends and family. Try to build a special emergency fund into your budget to cover your rent in a pinch.

Guarantor FAQs

What are the Pros and Cons of Having a Lease Guarantor?

- PRO: easier to approve younger tenants without rental history

- PRO: more security than a security deposit

- PRO: may help prevent evictions

- PRO: get the funds needed for back rent

- CON: does not guarantee a good renter

- CON: payment recovery process can still be challenging

- CON: the landlord may need to take two individuals to court for refusal to pay

- CON: landlords may need to contact two individuals for late payments

What Credit Score Does a Guarantor Need?

There is no minimum credit score requirement for a guarantor, but they typically have very good credit, reflected in a credit score of at least 750 or above.

How Much is a Guarantor Fee?

If you need a guarantor and decide to find one through a company, they usually charge a fee of up to 85 percent of one month's rent.

Does Being a Guarantor Have an Effect on Your Credit Score?

Being a guarantor does not affect your credit score. However, if you fail to cover any missed rental payments, that will have a negative impact on your credit.

Can You Be Your Own Guarantor?

In some rare instances, landlords may allow you to be your own guarantor if you put your assets up. Typically, however, if your landlord wants you to get a guarantor, it’ll be a third party.

Does a Guarantor Sign the Lease?

An apartment lease guarantor will sign the lease as a legally binding document. After providing their guarantor information, the landlord will request their signature on the lease agreement.

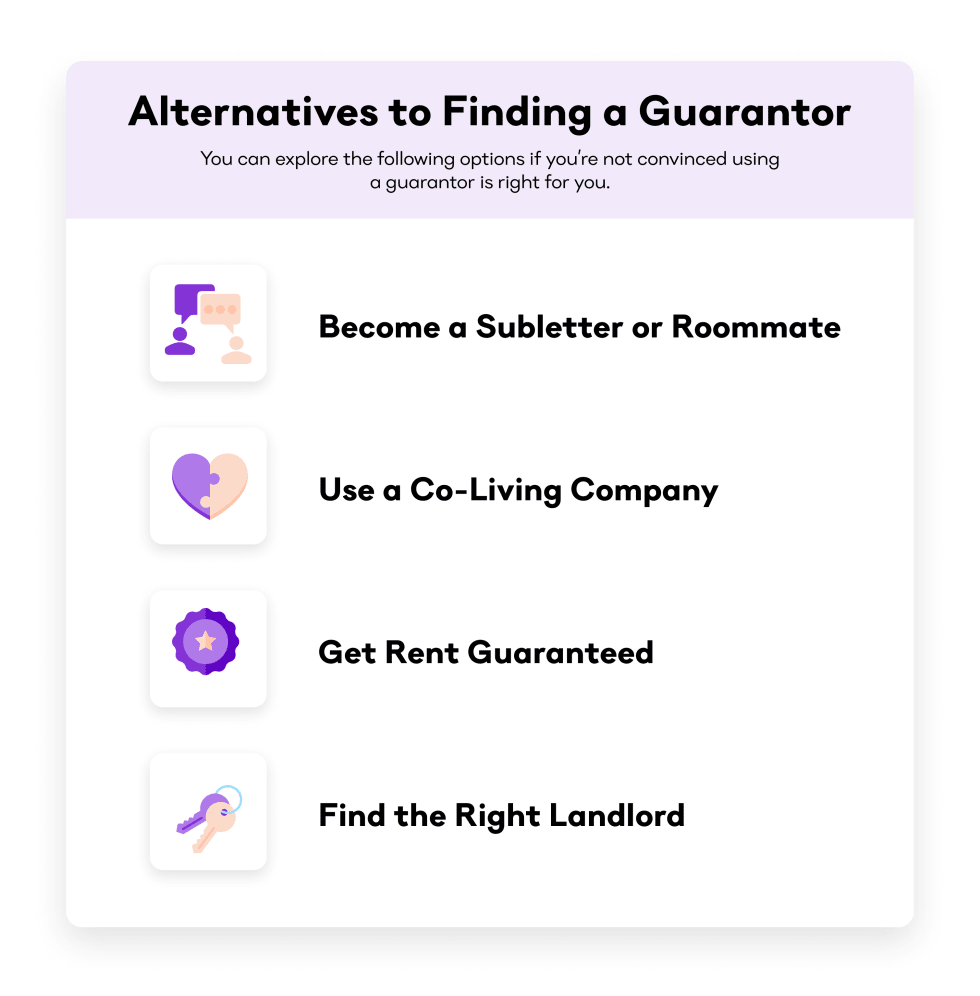

What if You Can’t Find a Lease Guarantor or Co-signer?

It's not the end of the world if you can't find a guarantor or co-signer for your lease. There are some companies like willing to act as your lease guarantor or co-signer.

Share this Article