Nearly One-Quarter of Americans Couldn't Pay Their April Housing Bill

- In the wake of the coronavirus, a historic number of Americans were unable to afford their rent and mortgage payments this month. 13 percent of renters paid only part of their April rent bill, while another 12 percent made no payment at all. A similar percentage of homeowners were delinquent on their mortgage obligations.

- 1 in 9 renters had their landlord or management company proactively lower their April rent. Among those missing their full payments, 45 percent of renters and 44 percent of homeowners were able to agree to reduced or deferred payments with their landlords and lenders, respectively.

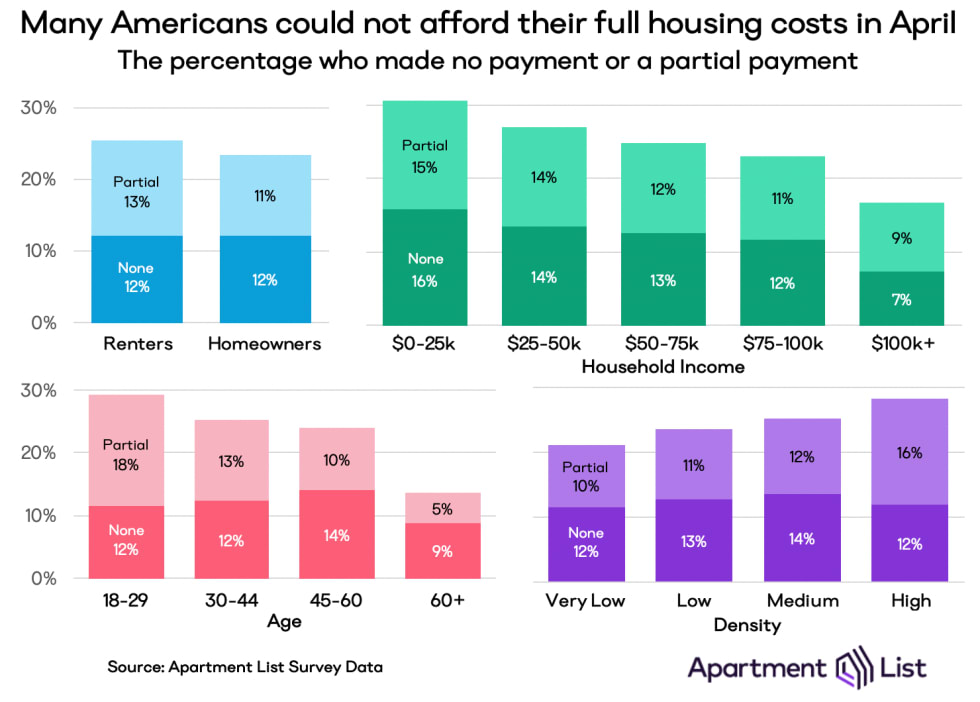

- Delinquency is correlated with a number of demographic factors. Poorer and younger households had more trouble affording their housing payments, as did those living in denser, more urban parts of the country.

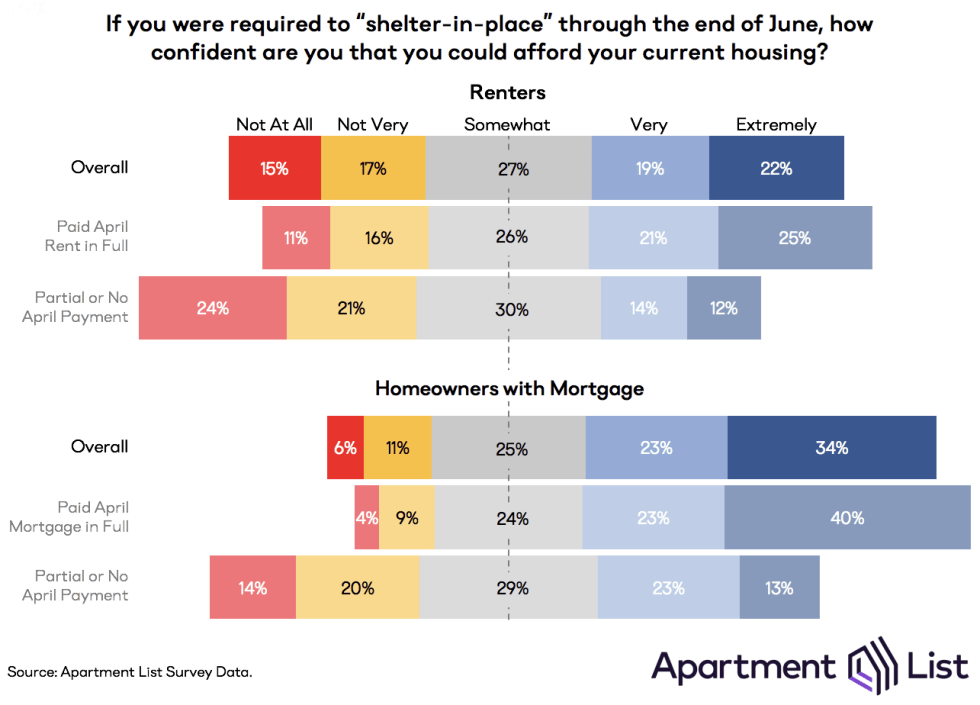

- The pandemic’s impact on housing affordability could very likely worsen in the coming months. Even among renters who paid their April rent in full, 27 percent are “not at all” or “not very” confident that they could continue to do so if shelter-in-place lasts through June.

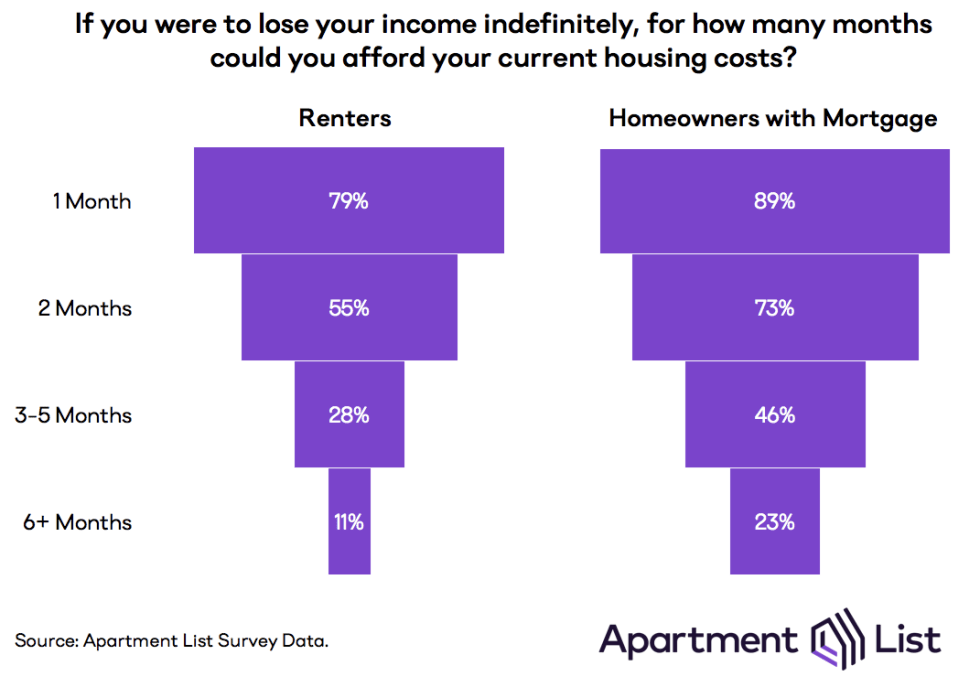

- For homeowners, housing security is buoyed by greater personal savings. Homeowners are over twice as likely as renters to say they could afford housing payments for six months or more if their incomes were lost indefinitely.

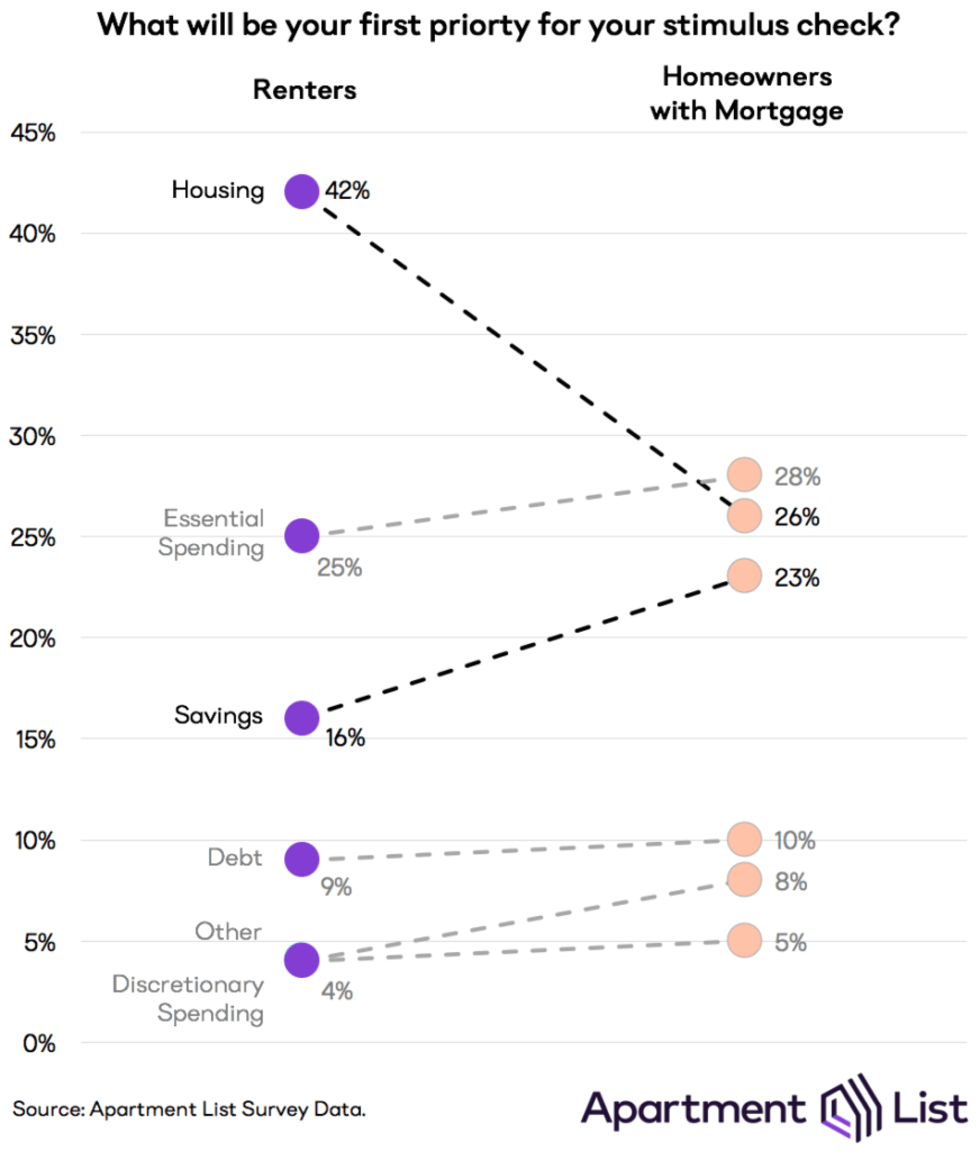

- Consequently, many renters will prioritize housing costs when government stimulus checks get deposited into their accounts. Homeowners are more likely to prioritize other forms of essential spending, and are more likely than renters to say that they will put their stimulus checks toward savings.

Introduction

This past week marked a turning point for the U.S. housing market. As the COVID-19 pandemic spread over the course of March, Americans increasingly adopted a new normal. Social distancing became not just a new buzzword, but a new way of life as shelter-in-place guidelines grew to cover most of the country. The new quarantine economy has frozen much of the country’s activity, and ten million workers have filed for unemployment insurance in just the past two weeks. In the midst of this public health and economic crisis, most Americans’ rent and mortgage checks came due on April 1.

To understand the pandemic’s immediate impact on the housing market, we designed a national survey to collect data on Americans’ ability to afford their April rent and mortgage payments.1 The 4,000+ survey responses, collected between April 3 and April 5, reflect a dire economic reality: in the span of just a month, the pandemic has already left tens of millions struggling to pay for housing.

One in Four Americans Did Not Pay Their Full Housing Costs in April

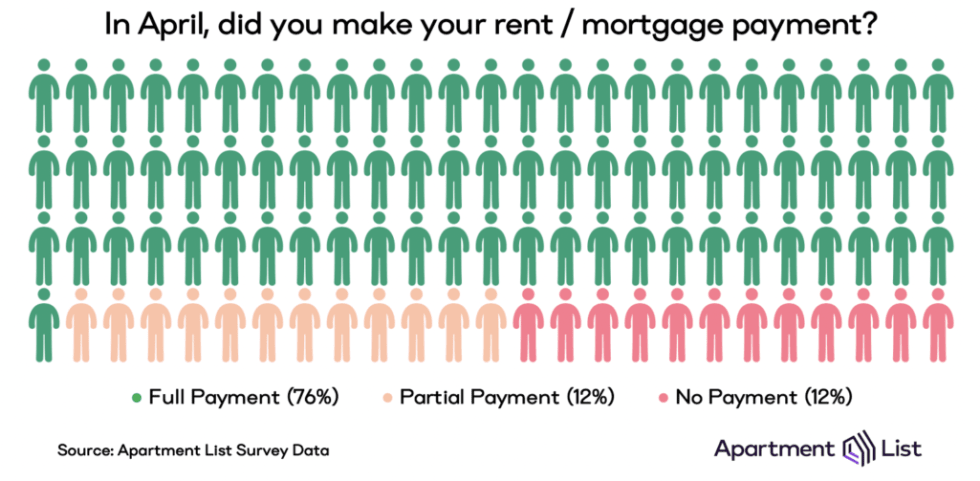

The ability to comfortably afford housing -- already an issue that many struggle with -- has plummeted during the COVID-19 pandemic. Our survey responses indicate that nearly 1 in 4 Americans were not able to pay their April housing bill in full. Half of those respondents were able to make a partial payment to their lender or landlord; the other half made no payment at all. Strikingly, 1 in 8 Americans who had a housing payment due this month has not yet paid any portion of it.

Despite the fact that homeowners have higher incomes and more assets than renters, April’s delinquency rate does not differ dramatically between the two. Thirteen percent of renters were only able to pay a portion of their April rent, while another twelve percent sent no rent check whatsoever. Among homeowners that hold a mortgage, eleven percent made a partial mortgage payment for April. Twelve percent did not pay their mortgage bill.

Needless to say, these rates are far outside the norm. Data from the most recent American Housing Survey collected in 2017 show that in an average month, 3.9 percent of renters will fail to pay full rent.2 In April 2020, we saw this delinquency rate skyrocket 550 percent, as over one-quarter of renters failed to pay their entire rent on time. Typical delinquency rates among mortgaged homeowners are even lower, and this month over 23 percent did not make a full payment on time.

Inability to pay for housing correlates with a number of demographic factors. As expected, low-income households were more likely to miss their April bill, though failure to pay was atypically common among high-earners as well. Nearly 17 percent of households making six-figure incomes are unable to afford their housing this month. Younger Americans were more likely to miss their rent and mortgage payments, with 30 percent delinquency among respondents under 30. Finally, renters and homeowners in dense urban centers, where social distancing wipes out more elements of daily economic life, were hit harder than those in suburbs and rural areas.3

Responses indicate that landlords and lenders recognize the financial difficulty that many are facing in these turbulent times, and have in many cases been willing to accomodate flexibility with payments. In some cases, these concessions are even being offered proactively by property owners and banks. Eleven percent of all renters indicated that their landlord proactively lowered their April rent. Seven percent of renters asked their landlord for a rent reduction that was approved. Six percent of renters requested to delay their rent payments and had their request approved. Among those who were not able to pay their full April rent, 45 percent received some sort of concession, having agreed to a reduced or deferred rent payment ahead of time.

Mortgage lenders have also designed new programs and policies for those financially affected by the COVID-19 pandemic. Survey responses indicate that 1 in 10 homeowners with a mortgage is deferring their April payment with no penalty. 1 in 20 is making a partial mortgage payment and not incurring a penalty. Many others are still in the process of arriving at an agreement with their bank. Among respondents with mortgage obligations, eleven percent are in the process of inquiring about payment deferrals or reductions.

Struggles with Housing Payments Could Worsen in the Coming Months

At this point, we do not know when or how the shelter-in-place ordinances and social distancing guidelines will be lifted. Current projections show that peak COVID-19 mortality is still ahead of us. Many Americans will continue to feel the economic consequences well into the summer months, and the longer-term economic outlook is even less clear. With the uncertain environment in mind, we designed several survey questions aimed at understanding what the coming months may bring for the housing market.

We asked all respondents, “If, hypothetically, your state were required to ‘shelter-in-place’ through the end of June, how confident are you that you would be able to afford your current housing through June?” We measured confidence on a five-point Likert scale. Only 41 percent of renters are “extremely confident” or “very confident” that they can keep making rent payments through June while continuing to practice social distancing. 27 percent of renters are “somewhat confident,” while 17 percent of renters are “not so confident.” 15 percent of renters indicated that they are “not at all confident” that they could afford rent if shelter-in-place ordinances remained through June. Even among renters who had made their April payment in full, 17 percent are “not so confident” or “not at all confident” in their ability to make payments going forward. These results indicate that May and June may be difficult months for the rental market.

Notably, although homeowners and renters faced similar rates of payment delinquency in April, responses to this forward-looking question unearth a clear divergence in expectations for the coming months across the two groups. Renters are disproportionately likely to work in the low-wage occupations being hit hardest by shelter-in-place restrictions, and accordingly, they seem to grow more worried about their ability to pay rent the longer these restrictions remain in place.

Compared to 41 percent of renters, 57 percent of homeowners are “very” or “extremely” confident in their ability to meet their mortgage obligations if shelter-in-place continues through June. Only six percent are “not at all confident” in their ability to pay through June if normalcy isn’t restored by the summer. Despite forecasting more optimism than renters did, as many as 1 in 8 homeowners who paid their mortgage in April still expressed serious doubt in their ability to do so going forward.

We also asked respondents to estimate how long they could continue to make their monthly housing payments if their household lost their income streams. The figure below shows that the share of households that can afford to pay for housing tapers off quickly as the number of months without income stretches on. 79 percent of renters believe they could make their next monthly payment even after losing their income. However, that figure drops to 55 percent after two months of lost income, and just 28 percent can last more than three months relying on their savings or support from others.

Homeowners expect their savings to cover their housing costs for a longer stretch of time. 73 percent expect to be able to make at least two payments after losing their income, while nearly half anticipate being able to pay for at least three months of their mortgage. Only 1 in 9 renters and 1 in 4 homeowners believe that they can afford their current housing costs for more than six months after losing their income sources.

Even though we do not yet know when the light at the end of the tunnel will appear, the rebate checks that will be issued as a part of the CARES Act promise some much needed relief in the near future. Americans filing as individuals or heads of households expect to receive as much as $1,200 in the coming weeks, while joint filers will receive $2,400 if they make less than $150,000 per year. Additional rebates will be added for dependents of those meeting income eligibility requirements. Might these payments help Americans catch up on their rent and mortgage payment?

We asked respondents to indicate their top priority in spending the relief funds, and plot the answers in the figure below. Renters indicate that housing payments are their top, collective priority upon receiving their checks. As a result, we expect that many CARES Act rebates will be used to help renters catch up on their April rent payments.4

Responses to this question also reinforce that homeowners have a stronger sense of long-term housing security than renters. Only 26 percent say housing costs are the top priority for their stimulus checks, compared to 28 percent who prioritize essential spending like groceries. Since fewer homeowners expect to put their stimulus money towards housing, more indicate they will save the money instead. Homeowners are over 40 percent more likely than renters to put their CARES Act checks into savings.

Looking Forward

Housing was at the core of the last recession, and today’s economic crisis is quickly disrupting the industry once again. But this time, the sacrifices we must make to protect public health are creating a unique set of challenges for the housing market. When incomes fall during a typical economic downturn, families can downsize and households can consolidate to shrink their housing costs. Today, many of these moves are on hold as well, blocking an important release valve for affordability pressures. As much of the country shelters-in-place, many Americans are changing their lifestyles and outlooks without the ability to change their location.

As we look forward to recovery, it is already clear that the COVID-19 pandemic and the new “quarantine economy” will have lasting effects on the housing market. To weather the storm, many renters are likely to deplete the savings that they had set aside for a downpayment. The prospect of millennial homeownership catching up to that of previous generations is becoming more bleak. New technologies will enable an unprecedented number of sight-unseen moves this summer. A forced “work from home experiment” has the potential to alter the geography of jobs across the country. But while the long-term impacts of the quarantine economy stand to shape the housing market in ways that will play out over years, it’s clear that the immediate consequences have already disrupted the housing stability of millions of American households.

- We partnered with SurveyMonkey to collect 4,129 responses across a panel of respondents that match the gender and age distribution of the United States as a whole.↩

- Apartment List estimates this delinquency rate using the 2017 American Housing Survey, which provides the percentage of renter households that miss one, two, or three months of rent during a three-month span. Raw data are available from the AHS Table Creator. The average one-month delinquency rate is equal to (renters who missed all three months) + (2/3 * renters who missed two months) + (1/3 * renters who missed one month) divided by the total number of renters.↩

- Density is defined as zip-code-level population per square mile. Very low is a population density of fewer than 1,000 residents per square mile; low is 1,000-5,000, medium is 5,000-10,000 and high is 10,000 or more.↩

- Our latest rent report estimates a median 2-bedroom rent in the U.S. of $1,197, just under the expected rebate for single-filers with eligible incomes.↩

Share this Article