In May, Even More Americans Missed Their Housing Payments

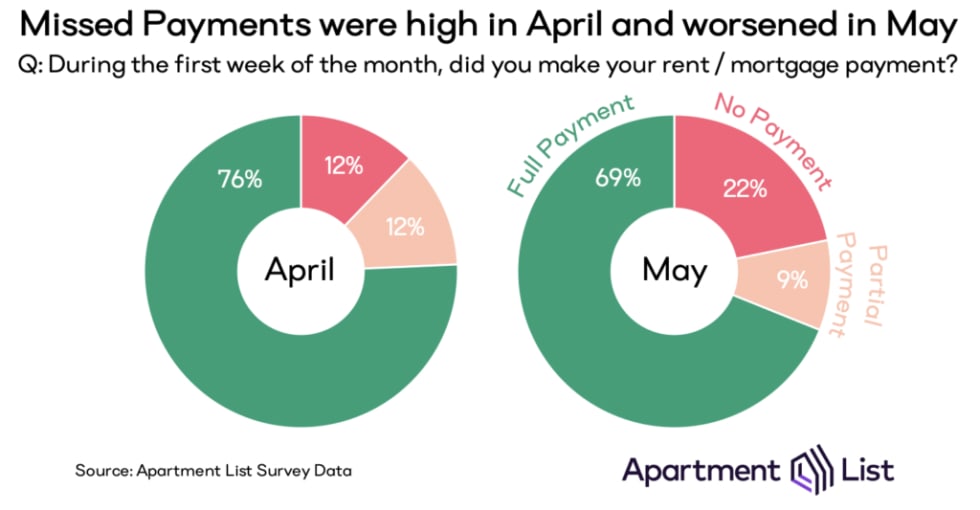

- In April, nearly one-quarter of housing bills were not fully paid during the first week of the month. In May the situation worsened, as 31 percent of Americans made just a partial payment or no payment at all.

- The majority of missed payments in early April were eventually made up over the course of the month. But for these people who needed the extra time to pay for April housing, May non-payment rates are extremely high.

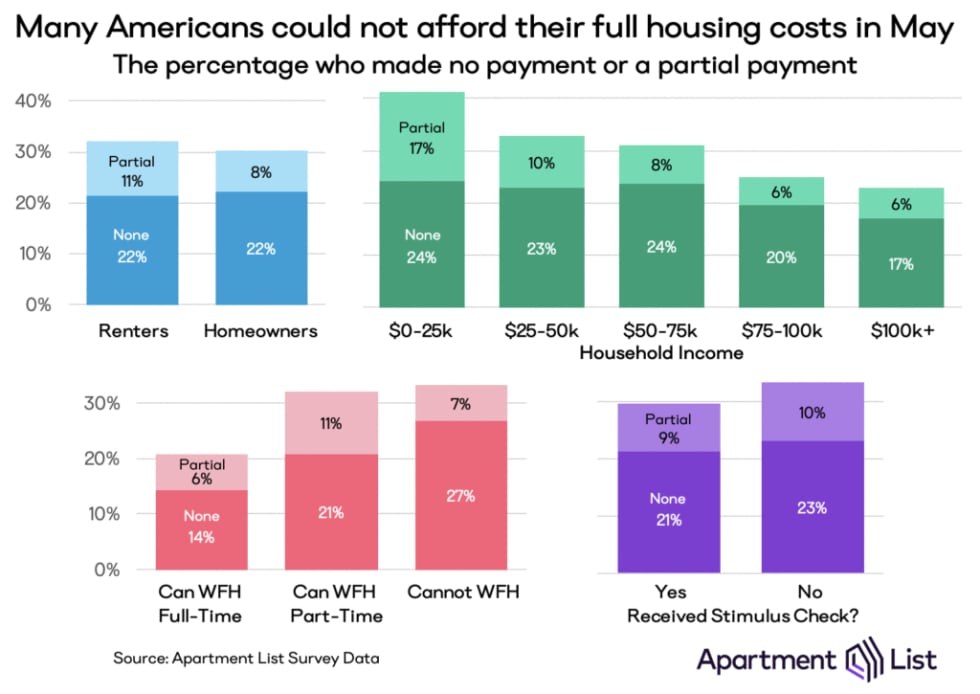

- Despite a significant wealth gap, renters and homeowners share similar results: 22 percent of each group made no housing payment in early May.

- Those who can work remotely have had an easier time affording housing, with a May delinquency rate 10 percentage points lower than those who can’t perform all of their job duties at home.

- Millions of Americans have received federal stimulus checks as part of the CARES Act, but those who received a stimulus payment were only slightly less likely to have missed their housing payment.

- Despite May’s affordability struggles, strong eviction and foreclosure protections and the gradual reopening of the economy are leaving Americans more confident about future housing security than they were last month.

Introduction

Nearly 1 in 4 Americans were not able to pay their housing bill in the first week of April, as COVID-19 upended much of our economy and imposed financial strain on millions of Americans. In the weeks since, millions more workers have filed for unemployment benefits, stoking a fierce debate around when it will be appropriate to “reopen the economy.” Amid this backdrop of continued economic instability and fears of worsening housing affordability, the pandemic’s second round of housing payments came due on May 1st.

To better understand the degree to which Americans are struggling to make these payments, we ran the second edition of our housing affordability survey in the first week of May, asking over 4,000 renters and homeowners whether they were able to pay their housing bills.1 The responses paint a picture that contains both good news and bad news. On the positive side, most of the bills that were missed in the first week of April were ultimately paid later in the month, as renters and homeowners worked out alternative arrangements with landlords and lenders. However, data from the first week of May indicate an even larger payment gap than what we saw last month. Over thirty percent of May housing bills have yet to be paid in full.

Housing Affordability During the Pandemic

Industry standards in rental and mortgage markets maintain that housing payments are due on the first of each month. As of the first week of May, however, 22 percent of rent bills and 22 percent of mortgage bills were entirely unpaid. An additional nine percent of Americans made a partial payment of their May housing bill, meaning that just 69 percent of rent and mortgage bills were paid in full as of the time of our survey.2 It’s clear that the record number of layoffs that have come on the heels of stay-at-home mandates have rapidly and significantly altered the affordability landscape in the U.S.

Our May survey paints an even more distressing picture than the data we collected in April. The share of housing payments made in full during the first week of the month fell by seven percentage points, from the 76 percent in April to 69 percent in May. The number of Americans unable to make any first-week housing payments shot up by over 80 percent. Fortunately, we continue to see landlords and lenders agreeing to concessions to arrive at alternative arrangements in light of widespread income loss. Seven percent of mortgage loans are now in forbearance, and ten percent of renters state that their landlord or property manager proactively lowered their May rent. Forty percent of renters who have not paid their May rent report that they have agreed to terms for reduced or deferred rent with their landlord.

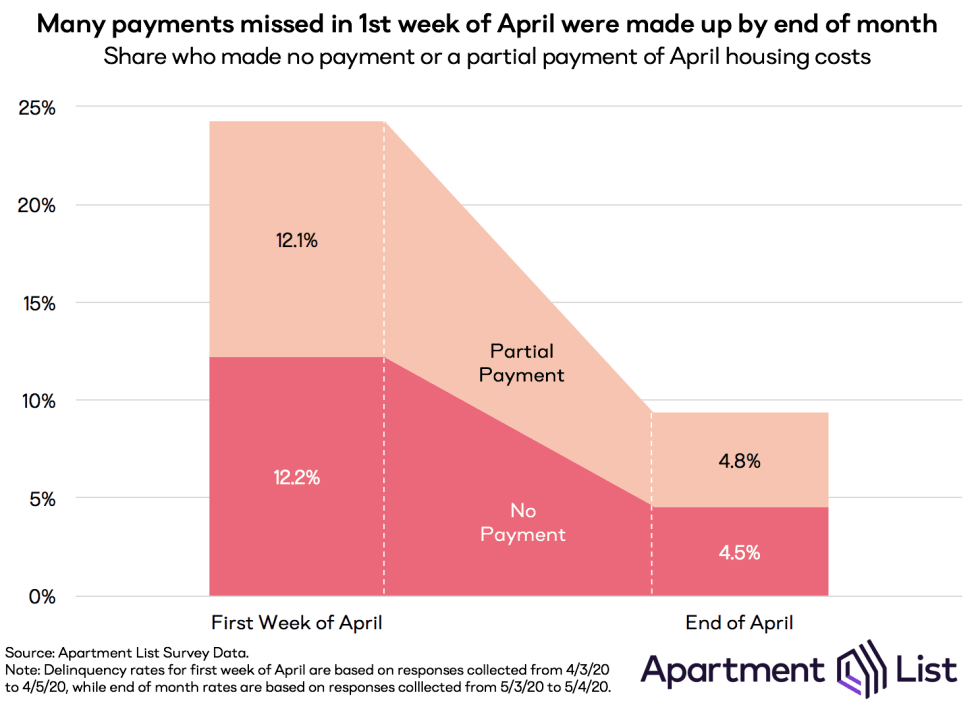

We also asked May survey-takers about their ability to make rent and mortgage payments in the prior month, adding important context to the non-payment rates in last month’s survey.3 The figure below shows the evolution of housing payments from the first week of April through the end of the month. Although many renters and homeowners missed payments in early April, we found that only 1 in 10 ultimately failed to pay their rent or mortgage by the end of the month.4 This share is far lower than the 1 in 4 who had not made their payment during the first week of the month. Although many families find themselves in need of flexibility throughout the pandemic, many appear to be following through with deferred payment plans. This finding offers hope that renters and homeowners may be able to close much of May’s massive payment gap before the end of the month.

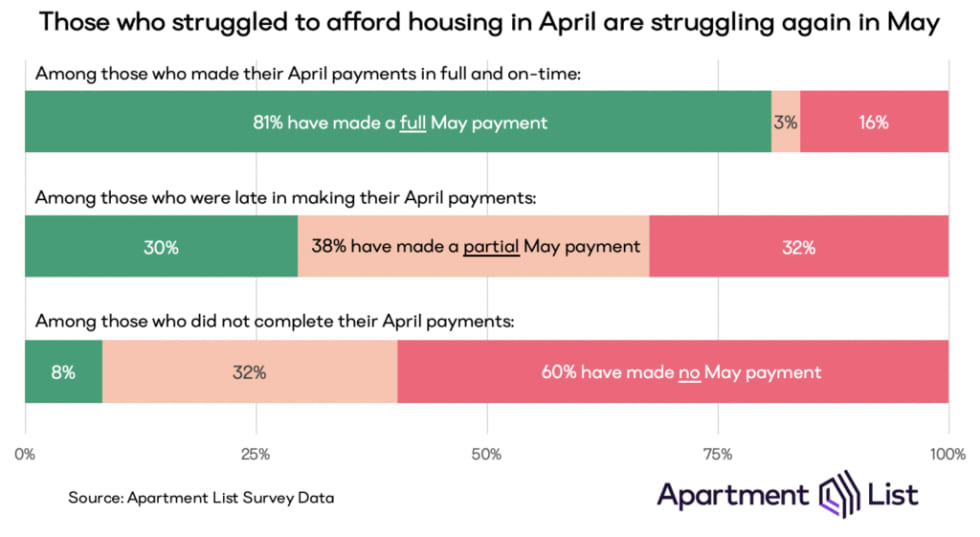

While it’s certainly promising that many missed April payments were made up over the course of the month, we see evidence that renters and homeowners who struggled last month are continuing to have difficulty. In fact, financial strain is spreading even to those that made their April payment in full. For those who made their April payment but needed extra time to do so, 70 percent were unable to make a full housing payment in early May. And for those who were not able to complete their April payments, the May non-payment rate skyrockets to 92 percent. May is proving to be a challenging month even for those who were in a good financial position in April. Among those who made April housing payments in-full and on-time, nearly one-in-five were unable to do so this month.5

Who Is Missing Payments?

In addition to unpaid bills rising in May, this month’s survey shows the continuation of more nuanced trends that we identified last month. For example, renters and homeowners continue to share similar delinquency rates, despite the wide gap in overall wealth between the two groups. Thirty-three percent of renters and 30 percent of homeowners have not yet made a full May payment (up from 25 and 23 percent in April, respectively). Lower-income families continue to struggle the most. For those making less than $25,000 per year, delinquencies rose from 31 percent in April to a staggering 41 percent in May.

However, not all of the trends we observed last month have continued. April’s missed payments were correlated with age and population density, but financial struggles in May have leveled out across these variables. Certain groups that found it easier to afford housing in April — particularly individuals over 60 and those living in low-density zip codes — had more difficulty paying their bills in May, as the pandemic has now spread to every corner of the country.

The Benefits of Remote Work

One factor that continues to be particularly important is the ability to work remotely. Under shelter-in-place guidelines, those who can work from home are benefitting from greater job security, an advantage that compounds the fact these occupations tend to be higher paid than those that must be done in person. In last month’s survey, we found that those who can work from home were having a significantly easier time making their housing payments. In May, this continues to be the case.

Although the missed payment rate for full-time remote workers increased from 17 percent in April to 20 percent in May, this rate is still significantly lower than that of workers with less job flexibility. May’s missed payment rate was 32 percent for those who can work from home only part-time, and 34 percent for those who cannot work from home at all, with non-payment more concentrated in the latter group, and partial payments more common in the former. Those whose jobs must be done at least partially in person also saw larger decreases in ability to pay compared to April.

The Impact of CARES Act Direct Stimulus Payments

Another factor that we were keenly interested in this month was the impact of the stimulus checks authorized by the CARES Act, which are specifically intended to help struggling Americans afford essential expenses such as housing and groceries. When we ran last month’s survey, the CARES Act had been passed but checks had not yet been sent out. At that time, 42 percent of renters said that paying rent was their top priority for the stimulus money. As of this month’s survey, a bit more than half of the 150 million Americans who qualify for stimulus have received it, giving us a better look at how these payments are impacting the rental and mortgage markets.

Despite the high share of respondents who said that they planned to use this money for housing costs, the overall May non-payment rate for those who have received a stimulus check is just three percentage points lower than the rate for those who have not. That said, this aid does appear to be a bit more impactful for renters than homeowners. Among renters who received their stimulus checks, 71 percent paid their May rent in full, compared to 64 percent of those who did not receive one. For homeowners, meanwhile, delinquency rates are nearly identical across those who have and have not received aid. The modest impact of stimulus checks on housing payments may be related to the legal protections currently in place that have put a freeze on evictions and foreclosures. With housing secure at least as long as these protections are in place, those who are struggling most may be prioritizing groceries and other forms of essential spending over rent and mortgage payments.

Have We Seen the Bottom?

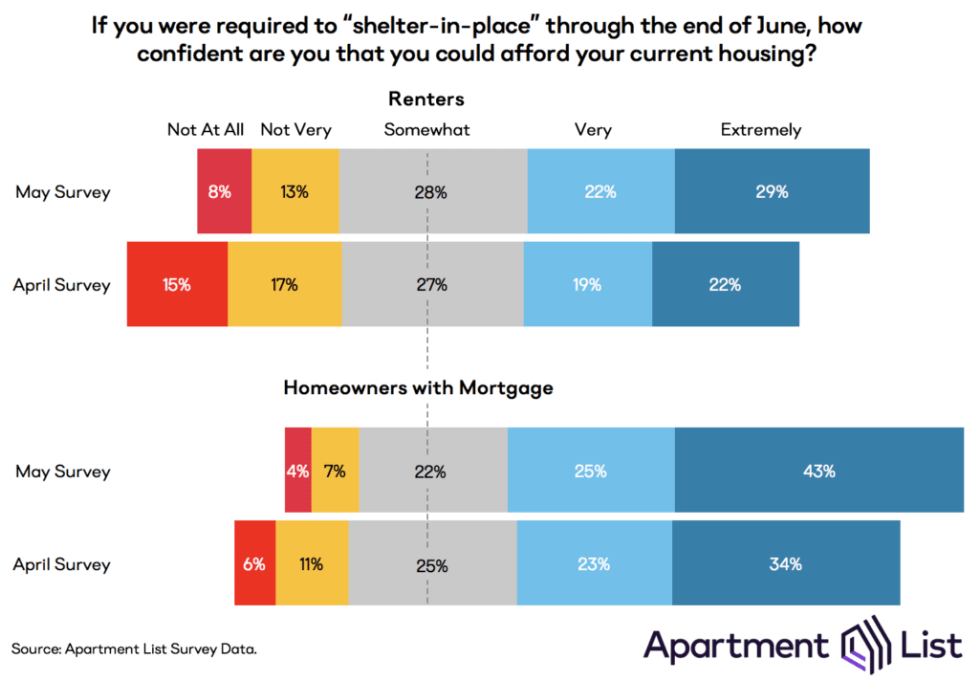

Even as COVID-19 deaths continue to climb nationally, many local economies are slowly lifting shelter-in-place guidelines in order to allow economic activity to recover. Renters are resuming their housing searches, and many businesses are beginning to plan for reopening. Against this backdrop, we find that even as respondents struggle with May housing payments, their outlook on future housing affordability has improved since April. Today, 79 percent of renters are at least somewhat confident that they can afford their June rent, even if “shelter-in-place” were to remain in effect. Homeowners are even more optimistic.6 Moreover, lifting “shelter-in-place” orders will allow people to move to adapt to their new economic circumstances. Households’ ability to downgrade their housing or move in with family or friends will help the housing market weather the storm.

With that said, the strength of the housing market continues to depend on factors outside of its control -- namely, the spread of COVID-19 and the associated toll on public health. If a renewed surge in cases leads to a second round of social distancing, it could overwhelm the economy and exhaust the limited buffer of savings that many Americans are currently depleting to continue making their housing payments. If, on the other hand, testing, treatment, and collective behavioral change can catalyze a smooth return to work and relative economic normalcy, the dynamism of the housing market may bounce back quickly. Even if it does, though, the places, policies, and preferences that drive the U.S. housing market will look quite different than they did before the pandemic hit.

- Similar to last month’s survey, we again partnered with SurveyMonkey to collect responses across a panel of respondents that match the gender and age distribution of the United States as a whole.↩

- Results indicate that 68 percent of renters and 70 percent of homeowners with a mortgage have paid their May 1 bill in full.↩

- These data were not collected through a panel survey. We surveyed a different sample of renters and homeowners in each month.↩

- By the end of April, 11 percent of renters and 8 percent of homeowners with a mortgage had paid their April 1 bill in full.↩

- These statistics were consistent across renters and homeowners with a mortgage.↩

- This rise in optimism is consistent across geography. It was recorded in states that have and have not started reopening their economies.↩

Share this Article