The Bank of Mom and Dad: Many Millennials Rely on Family to Afford Housing

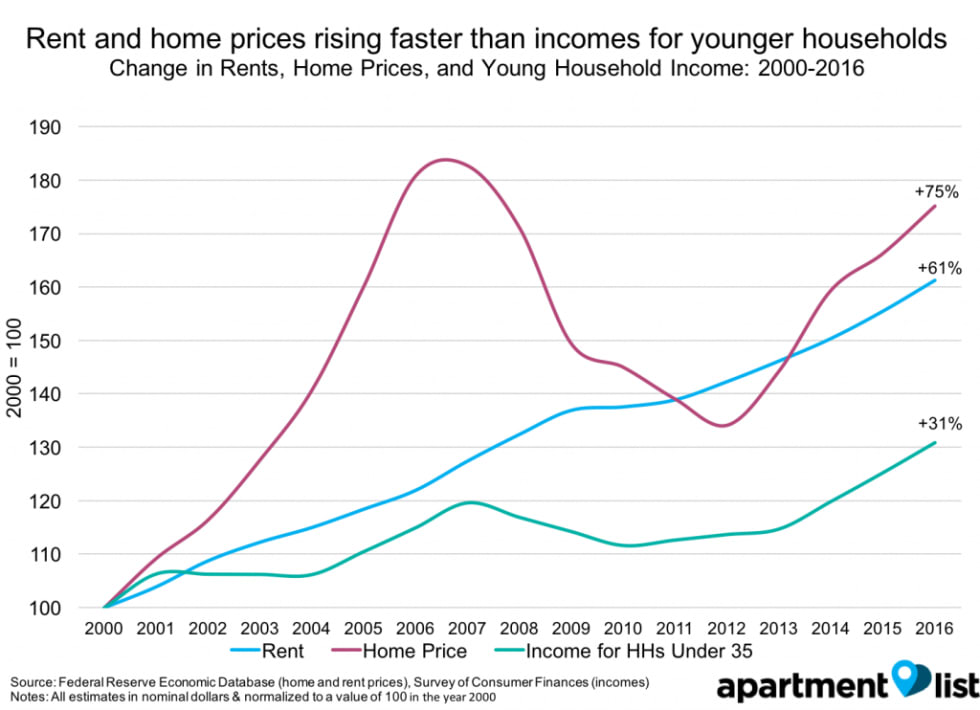

- Since 2000, home and rent prices have increased by 73 percent and 61 percent, respectively, but incomes for younger households have only increased 31 percent. Struggling to keep up with high housing costs, many millennials turn to family members for assistance.

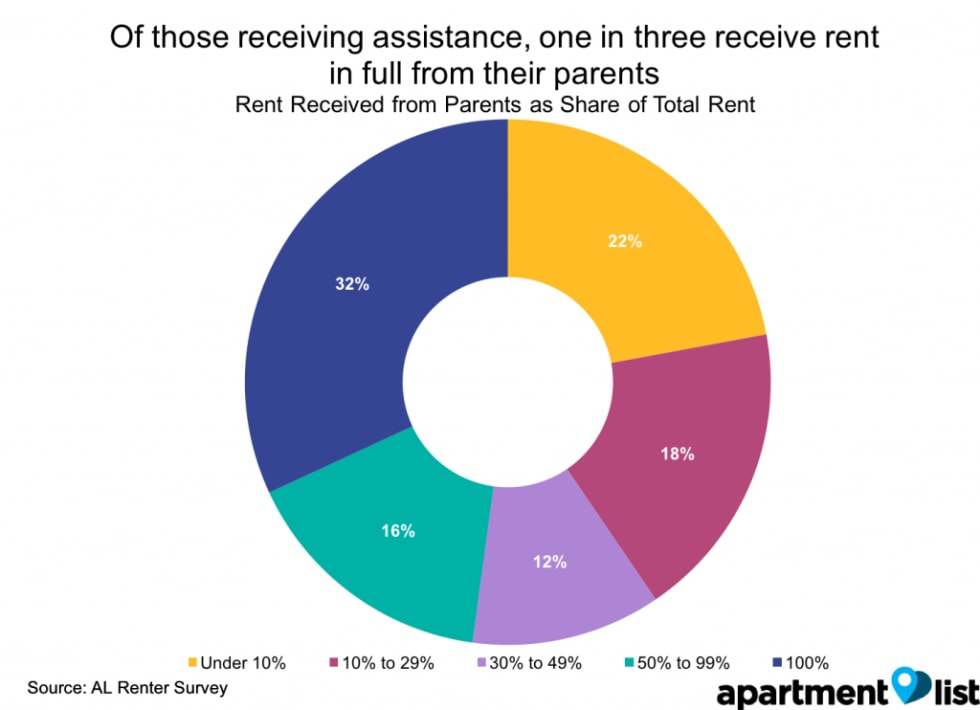

- 7.9 percent of non-student millennials surveyed receive money from family members to pay their monthly rent payments. Of those receiving help, the parents of one in three millennials pay their children’s rents in full.

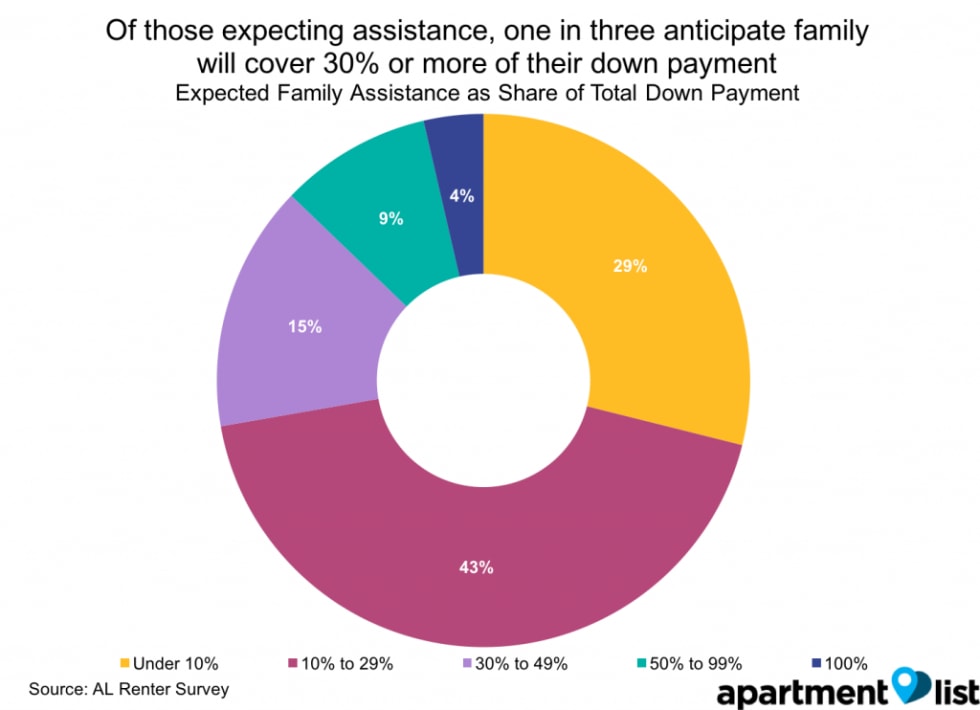

- 17.1 percent of millennials surveyed expect financial help from family towards a down payment. Of those, one in three anticipate family support will cover at least 30 percent of their down payment.

Millennials, the generation born between 1982 and 2004, are often characterized as lazy and entitled. Australian millionaire Tim Gurner infamously blamed the inability of millennials to purchase homes on their spending $19 on avocado toasts. In reality, millennials face a real estate market where rent and home prices have grown faster than incomes for decades, leaving millennials struggling to achieve the American Dream. Even college-educated millennials, who tend to earn higher incomes, struggle to save for homeownership due to the increasing burden of student loan debt.

Many have accused millennials of relying on their parents for money, rather than paying their own way, and these claims are not unfounded. Apartment List analyzed data from over 13,000 respondents to an annual survey we conduct and determined the share of millennials receiving help from family members with rent or a down payment. Of those surveyed, 7.9 percent of non-student millennials receive help from parents for their monthly rent, and 17.1 percent expect help with a down payment. Rent and down payments are far from the only areas where millennials receive help, and our figures understate the share of millennials receiving some form of financial assistance from family. A USA Today/Bank of America poll found that 40 percent of millennials receive help from parents with everyday expenses, including rent, child care, phone bills and car payments. An even larger share likely receive one-time help, such as help with a down payment, moving costs or money after losing a job.

In a housing market where housing costs have outpaced incomes, it’s not surprising that millennials are willing to accept financial assistance. An article in the Journal of Economic Perspectives estimates that as much as 20 percent of wealth can be attributed to formal and informal gifts from family members, but many people receive little or no assistance. Although renters from a lower-income background are more likely to need assistance, they are less likely to have parents who can support them, reinforcing existing wealth inequality. When primarily higher-income families are able to support their adult children, income inequality is transferred from generation to generation. Additionally, family can provide a much-needed safety net to get through financial troubles, such as a bout of unemployment or an unexpected medical procedure. Even a small amount of support in difficult times can prevent a spiraling of events stemming from an eviction or from the use of an emergency payday loan or credit card, both of which carry high interest rates.

Rent and Home Prices Rising Faster Than Incomes

Housing costs have been rising faster than incomes for decades, leaving many renters struggling to pay rent and save for a down payment. One in four renters spend over half of their income on rent, and 15 percent of 25- to 35-year-old millennials still live with their parents to save money on rent. Since 2000, home prices have increased 2.4 times more than incomes for households headed by someone under 35. Rents have increased 61 percent since 2000, more than double the growth in incomes for young households over the same period.

Given these long-term trends, it’s not surprising many millennials accept help from family for their rent or a down payment on a home. While income growth has picked up since 2013, home prices are rising at a much faster rate. Many jobs don’t pay enough to allow renters to afford rent, let alone save for a downpayment. Of respondents who are receiving rent assistance from their parents, some are unemployed, but many are in service jobs working as receptionists, nurses, teachers and cashiers.

7.9 percent of non-student millennials receive monthly help from their parents with rent

Overall, 10.8 percent of millennials and 7.9 percent of non-student millennials receive monthly rent money from their parents. While rental assistance is more common with younger renters, it’s not just millennials getting help from their parents. With sky-high rents in many cities, 2 percent of renters over 40 receive help from mom and dad. These figures likely understate the overall prevalence of parental assistance, as some millennials receive assistance from parents for no specific expense, and others receive help with one-time costs such as a deposit, moving costs or furniture.

For our calculations on the amount of assistance that millennials receive, we limit the sample to non-student millennials who are currently renting a home. The findings are based on voluntary responses to a survey sent to Apartment List users between August 23, 2017 and February 12, 2018. Apartment List users may not perfectly represent the general population, as the platform is online and app-based and tends to feature large, multifamily properties.

Most millennials receiving help get relatively small amounts from their parents each month. An estimated 31 percent of renters receiving assistance get under $100 per month from their parents, but a significant share are receiving much larger amounts. An estimated 20 percent of millennials receiving assistance receive a total of $8,400 or more each year. Of those receiving assistance, 10 percent receive $1,000 or more per month.

Of the renters receiving assistance, one in three receive rent in full from their parents. About 60 percent pay less than half of their rent, thanks to the bank of mom or dad. The thousands of dollars per year parents contribute to their children’s rent allows millennials to live in apartments they wouldn’t be able to afford, pay off student loans quicker or save for a downpayment.

17.1 percent of millennials expect help from family with a down payment

Receiving help with a down payment is far more common than receiving help with monthly rent payments. Nearly one in five renters anticipate help from family members in purchasing a home. Of those expecting assistance, many expect smaller sums, with one-third anticipating less than $1,000 from family. 15 percent expect $10,000 or more from family, enough for about one-fourth of a down payment on the national median priced condo. Of those expecting family assistance, 4 percent anticipate receiving $40,000 or more from family, a sum that can take renters without family support years or even decades to save up.

To calculate the share of a future down payment millennials expect family members to cover, we use self-reported, expected total down payment and expected family assistance. In our previous research, we found millennials greatly underestimate the savings needed for a downpayment. For example, in the Los Angeles metro, renters anticipate needing $36,340, but a 20 percent down payment on the median priced condo costs more than twice that amount. When millennials’ down payment savings fall short, or housing costs rise rapidly, renters may seek additional help from family.

Nearly one in three renters expecting help anticipate their family will cover at least 30 percent of their total down payment. Most commonly, renters expect family to cover 10 to 30 percent of the down payment. Saving for a down payment can take millennials as long as 20 years in some metros, but parental assistance cuts down on the time needed to save. In a real estate market where homes prices have increased 2.4 times faster than young household incomes, family assistance allows a subset of millennials to achieve homeownership years before they’d be able to without support

Assistance in purchasing a home is one of the more common ways higher-income families pass wealth to their children and grandchildren. According to research from Brandeis University, due to help from family members, white families buy homes and start acquiring equity eight years before black ones. This help allows renters to spend less of their own savings and begin accumulating wealth earlier, but also increases inequality between those who have families who can help and those who do not.

Conclusion

Millennials face a housing market where rent and home prices have risen faster than incomes for decades. In cities such as Denver and Seattle, rents increased by over 70 percent from 2005 to 2016, and starter homes are in high demand but short supply. In order to keep up with rent and home prices, many millennials receive financial support from families. While many millennials could use support from family to keep up with housing costs, only some have family that is able to provide financial support. Thus, financial support from family tends to reinforce existing class structure and contributes to income inequality.

Apartment List research shows 7.9 percent of non-student millennials receive help from their parents with monthly rent payments. While most of these renters receive relatively small sums each month, one in three receive rent in full from their parents. Even small payments can make a big difference each month, allowing renters to put an additional $100 or $200 towards student loan debt, a car payment or into their savings. Another common means of family help is with down payment costs. An estimated 17.1 percent of millennials anticipate parental assistance with a down payment. Of those, one in three anticipate family support will cover at least 30 percent of a down payment. These figures understate the total share of millennials receiving support with living costs, as parents cover a wide range of expenses beyond rent and down payments.

We’ve compiled estimates of the share of millennials receiving rent and down payment assistance in some of the country’s largest metros below. To provide a larger sample size, the rental assistance figure is not limited to non-student millennials. Local figures are based on a smaller sample size than the national estimates, and thus tend to be more volatile.1

| Metro | Rent | Down Payment |

|---|---|---|

| National | 10.8% | 17.1% |

| Atlanta, GA | 12.3% | 8.0% |

| Boston, MA | 5.5% | 19.3% |

| Chicago, IL | 9.5% | 18.6% |

| Dallas, TX | 9.8% | 16.5% |

| Denver, CO | 14.5% | 22.4% |

| Houston, TX | 10.1% | 17.1% |

| Los Angeles, CA | 12.0% | 21.6% |

| New York, NY | 13.6% | 18.1% |

| Phoenix, AZ | 14.5% | 16.0% |

- The standards of error for the national rent and down payment assistance figures are .59% and .65%, respectively. Local figures are based on a smaller sample size and thus have a larger standard of error. For a location specific standard of error or other questions about methodology please contact rentonomics@apartmentlist.com.↩

Share this Article