Teachers Increasingly Struggle with Housing Affordability

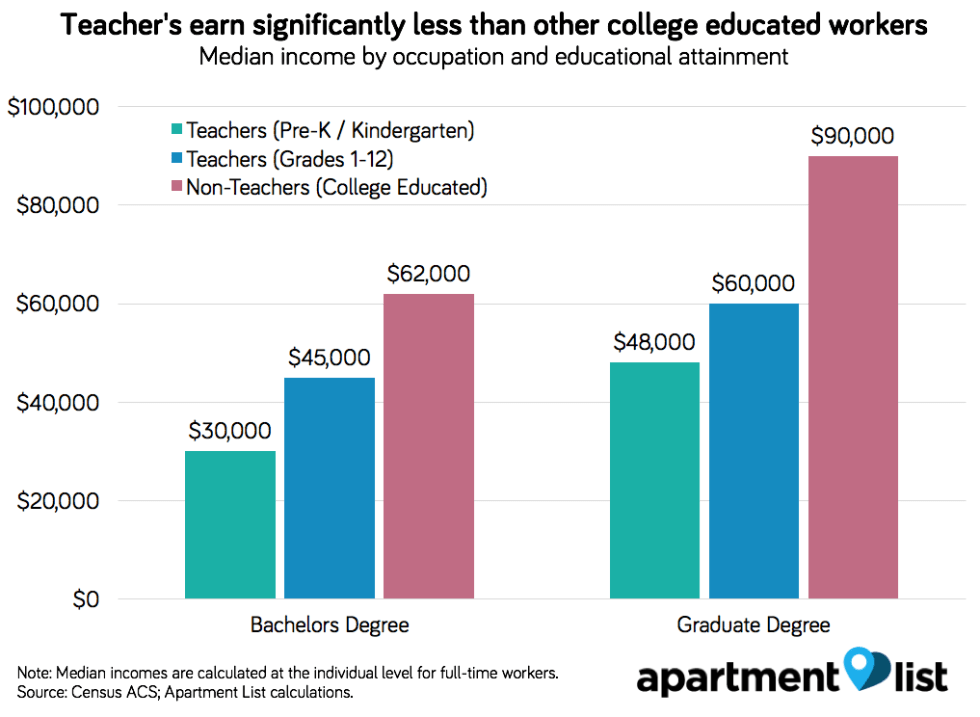

The median income across primary and secondary school teachers with Bachelor’s degrees is 27.4 percent less than that of non-teachers with Bachelor’s degrees. Teachers with Master’s degrees earn 33.3 percent less than similarly educated non-teachers. These wage gaps are even more extreme for preschool and kindergarten teachers.

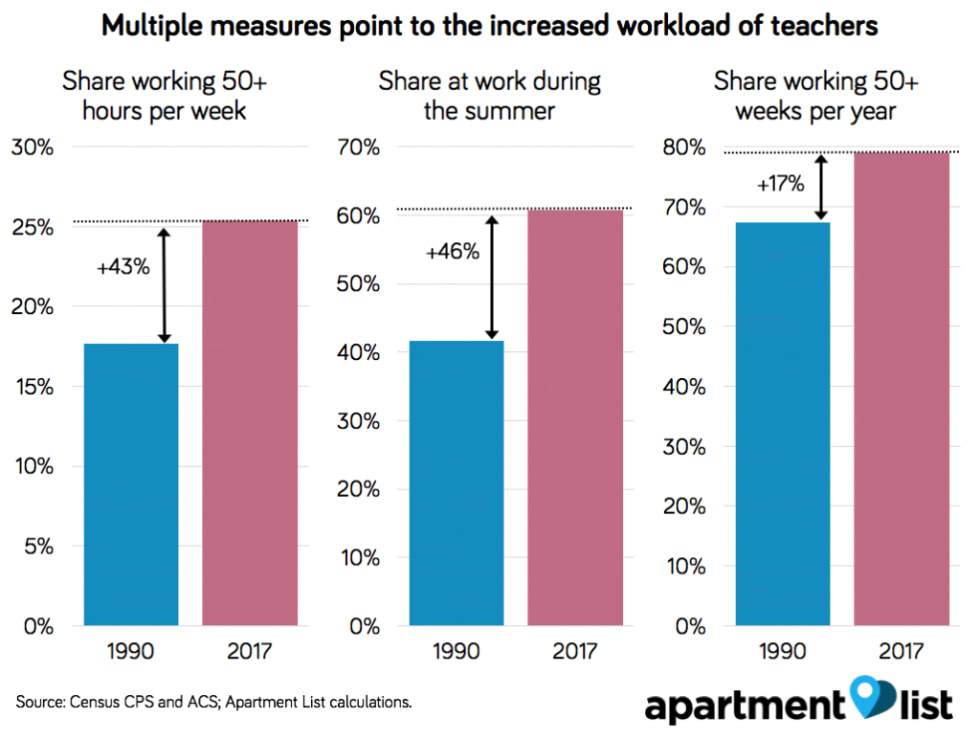

Between 1990 and 2017, the share of teachers who report working more than 50 hours per week increased by 43 percent, the share who report being at work during the summer increased by 46 percent, and the share who report working at least 50 weeks per year increased by 17 percent.

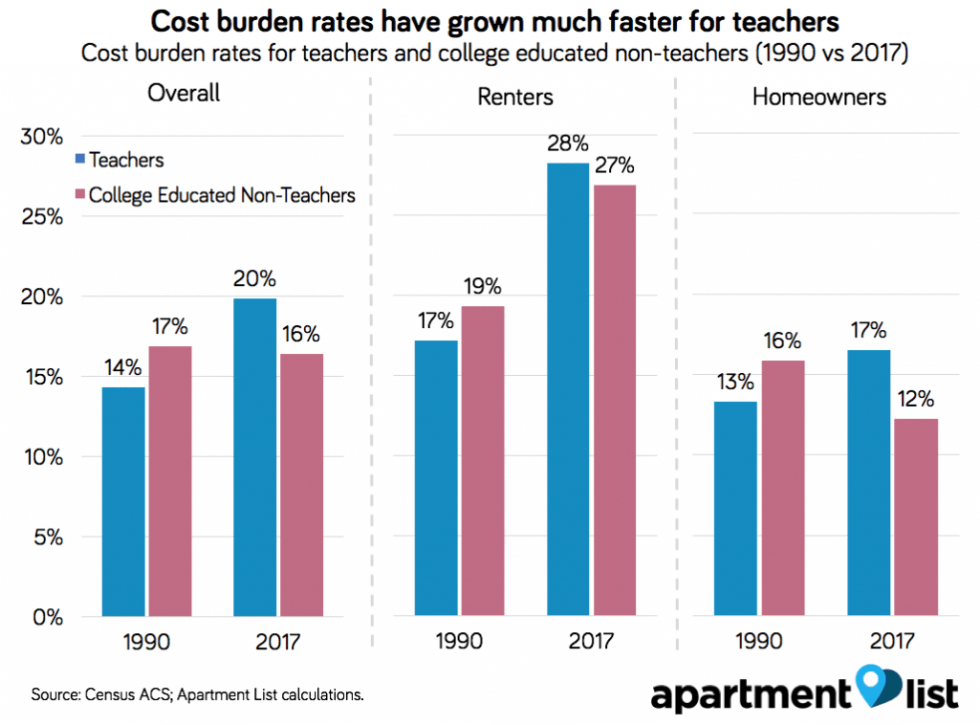

Nationally, 19.9 percent of primary-earner teachers are burdened by their housing costs. This is 21.3 percent higher than the cost-burden rate for households where the primary earner is a non-teacher with a college degree. This gap has widened over time; in 1990, the cost burden rate for teachers was 15 percent lower than that of college-educated non-teachers.

Teacher cost burden rates are highest in expensive coastal metros. Of the 25 largest metros, Miami has the highest cost burden rate for primary-earner teachers at 35 percent, followed by San Francisco, Los Angeles, San Diego, and Washington D.C.

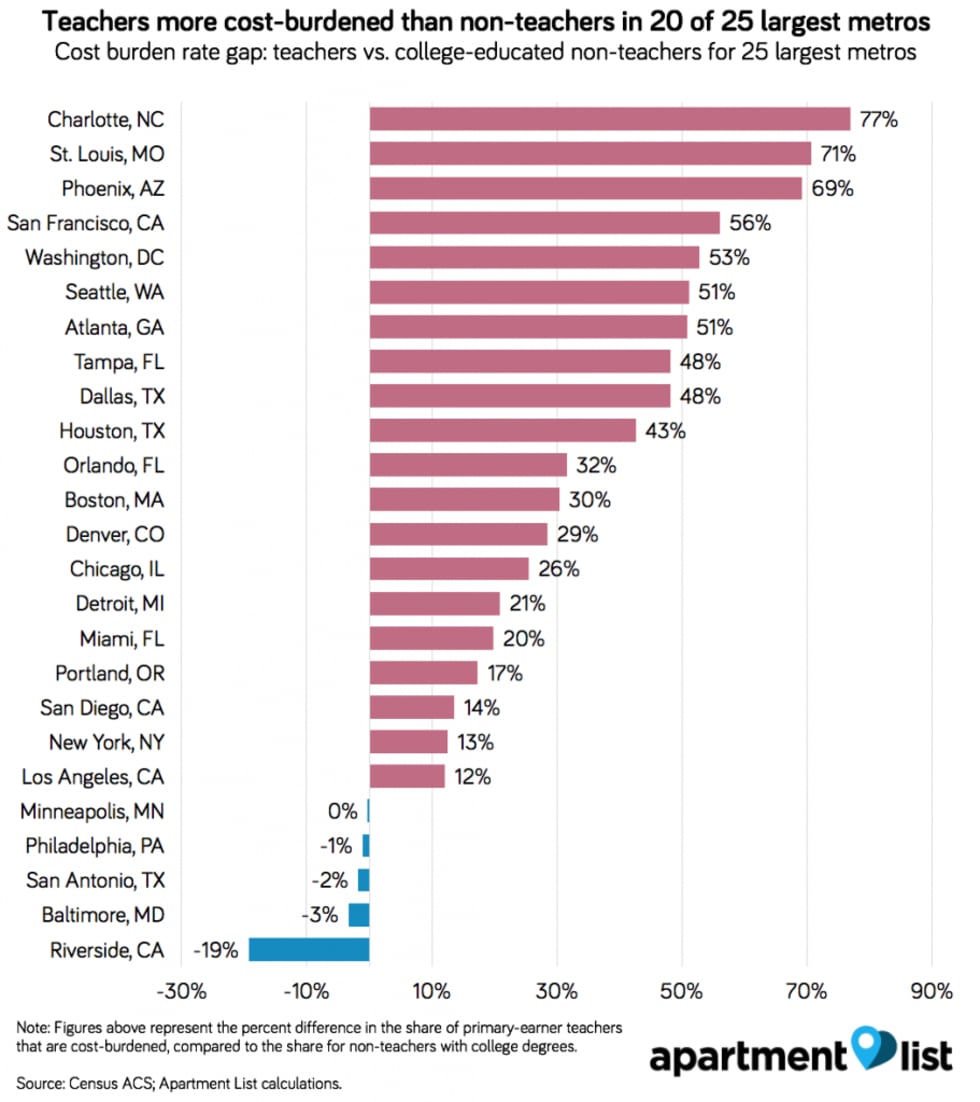

Teachers are more cost-burdened than other college-educated professionals in 20 of the 25 largest metros. Charlotte, NC has the largest gap, with a teacher cost-burden rate that is 76.9 percent higher than the rate for non-teachers with college degrees. We also observe cost burden rate gaps of more than 50 percent in St. Louis, Phoenix, San Francisco, Washington, D.C., Seattle, and Atlanta.

Download Local Data for 50 Largest Metros

Introduction

Teachers play an undeniably crucial role in society. By educating and mentoring the nation’s youth, teachers are instrumental in laying the foundation of our collective future, and the burden of that responsibility makes teaching a demanding and stressful profession. However, those who enter teaching professions take an implicit pay cut relative to other professions that require a similar amount of education and skill; we estimate that teachers earn 25.7 percent less than other college-educated professionals.

While teaching has long been a comparatively low-paying profession, rapid increases in housing costs have exacerbated the struggle of teachers. While rates of housing cost burden among teachers are lower than the national average, they are higher than that of other Americans with college degrees, and in certain parts of the country -- particularly the nation’s high cost coastal metros -- teachers are especially strained.

The difficulty of getting by on a teacher’s salary has sparked a wave of teacher strikes which began in West Virginia last February, and has since spread across the country, with strikes having taken place in locations including Oklahoma, Arizona, Los Angeles, Denver and Oakland, among others.1 In order to better understand this important issue, we analyzed data from the Census Bureau’s American Community Survey and Current Population Survey to paint a fuller picture of the financial and housing situations of America’s teachers.

Teachers earn significantly less than other college-educated workers

While it may be common knowledge that teachers are not particularly well-paid, the magnitude of the pay gap between teachers and other college-educated professionals is striking. In 2017, the median income for teachers with bachelor’s degrees in grade 1-12 classrooms was $45,000, which is 27.4 percent less than the median income of full-time workers with Bachelor’s degrees employed in non-teaching professions.

The gap between teachers and non-teachers with similar levels of education is even greater for those with graduate degrees; among those with a master’s degree or higher, teachers earn 33.3 percent less than non-teachers. Note that these figures are based on total earnings, including the money that many teachers earn from second jobs, making these gaps all the more distressing.

While teacher earnings are fairly consistent across primary and secondary school teachers, early childhood educators earn far less. We find that preschool and kindergarten teachers with bachelor’s degrees earn a median income of just $30,000, while those with graduate degrees earn $48,000 at the median, 46.7 percent less than non-teachers with similar levels of education. This is particularly troubling given the importance of early childhood education. Research has shown that kindergarten teacher quality drives key economic outcomes in adulthood, including earnings, homeownership, and retirement savings.2

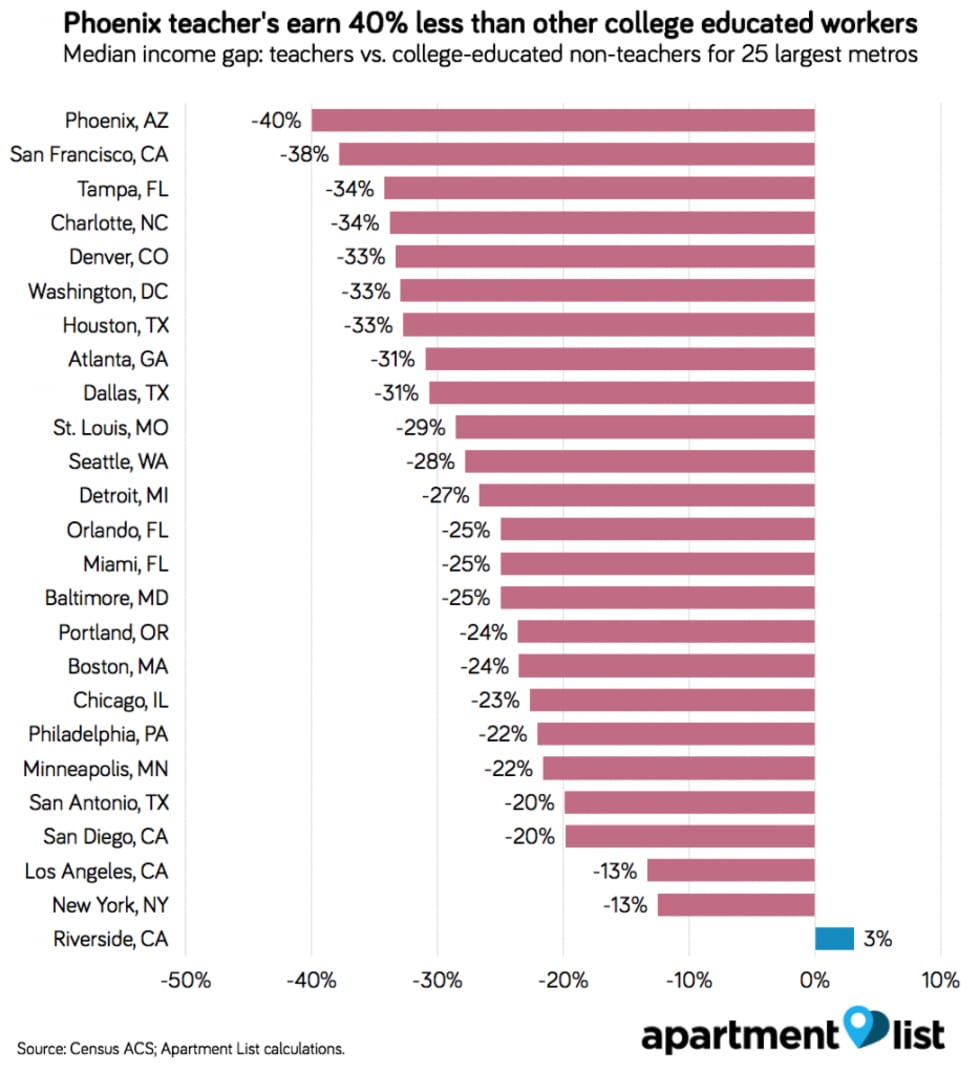

Teacher earnings also vary substantially by location. At the upper end of the spectrum, teachers in the Los Angeles, Boston, New York, and Riverside, CA metros all earn median incomes of $65,000 or more, while teachers in the Charlotte, Miami, Orlando, Tampa, and Phoenix metros earn median incomes of $45,000 or less. Generally, teachers are paid more in higher cost areas, but there are exceptions. Miami, for example, is one of the nation’s more expensive markets but has the fourth lowest median teacher salary among the 25 largest metro areas.

Teachers earn less than other college-educated professionals in all but one of the nation’s 25 largest metros. This gap is most extreme in Phoenix, where teachers earn 40 percent less than non-teachers with college degrees. While non-teacher incomes in Phoenix do not rank among the nation’s highest, the metro has the lowest median teacher pay among the 25 largest metros.

Interestingly, these wage gaps are not directly correlated with cost of living. We do observe particularly large wage gaps in some of the expensive metros where high-paying jobs for non-teachers are plentiful, including San Francisco, Denver, and Washington, D.C. However, the New York and Los Angeles metros, which also rank among the nation’s most expensive, actually have the second and third lowest wage gaps, due to relatively high teacher pay. Meanwhile, a number of more affordable markets, including the aforementioned Phoenix metro, as well as Tampa and Charlotte, have particularly large wage gaps that reflect the below-average salaries of teachers in these areas.

Despite working more, teachers still can’t get ahead

Many assume that teachers get summers off, and that this is a benefit of teaching that may partially justify the wage gap described above. However, we find that a majority of teachers work year-round, and multiple measures point to teachers working more than ever.

Census data shows that in 1990, 67.3 percent of teachers said that they worked 50+ weeks per year, but by 2017, that figure had risen to 78.9 percent. Note that the survey question that underlies this statistic prompts respondents to include paid vacation in the number of weeks worked, so there may be ambiguity in how teachers interpret this question. That said, we find additional evidence of an increase in teachers working during the summer from a separate survey question that asks if respondents were at work during the prior week. We estimate that the share of teachers who reported being at work during the summer months increased by 46 percent from 1990 to 2017, rising from 41.7 percent to 60.7 percent.

In addition to teachers working more weeks out of the year, the number of hours they work each week is also on the rise. The share of teachers who reported working 50 or more hours during a normal work week increased from 17.7 percent in 1990 to 25.3 percent in 2017. Taken together, these metrics paint a picture of increasing workloads for America’s teachers.

It would be intuitive to assume that this additional work may be the result of teachers supplementing their incomes by spending more time at second jobs. However, despite working more, the average share of teachers’ total income coming from their primary teaching job has remained relatively stable over time. This implies that either (1) teaching jobs have become more demanding and the extra work that teachers are doing is at their primary jobs or (2) teachers’ side jobs have become less lucrative, and teachers need to work more at secondary jobs to supplement their incomes by a similar amount.

One-in-five primary-earner teachers are burdened by housing costs

In order to assess the ability of teachers to afford housing, we calculate cost burden rates for teachers who are “primary earners,” meaning that they earn more than 50 percent of the income for their household. Cost-burdened households are those that spend more than 30 percent of gross household income on housing costs. Note that teachers are far less likely than other college-educated professionals to be primary earners. Just 52.9 percent of teachers are primary earners, compared to 81.4 percent of non-teachers with college degrees, speaking to the difficulty of supporting a household on a teacher’s salary alone. Among primary earners, we find that teachers are more likely to be burdened by their housing costs than college-educated non-teachers, and that this disadvantage has gotten worse over time.

Nationally, 19.9 percent of households in which a teacher is the primary-earner are burdened by their housing costs. This is 21.3 percent higher than the cost burden rate for households where the primary earner is a non-teacher with a college degree. This gap has widened substantially over time; in 1990, the cost burden rate for teachers was actually 15 percent lower than that of college-educated non-teachers. While the cost burden rate for non-teachers fell by 2.7 percent from 1990 to 2017, the rate for teachers increased by 38.8 percent.

Housing costs present even more of a challenge for certain segments of the teacher population. Among primary-earner teachers who rent, the cost burden rate was 28.2 percent as of 2017, up from 24.5 percent in 2010. Also of note, preschool and kindergarten teachers fare much worse than teachers in grade 1-12 classrooms. Preschool and kindergarten teachers who are primary earners have a cost-burden rate of 41.2 percent, more than double the rate for teachers as a whole.

Similarly to the income statistics above, national average cost burden rates for teachers mask substantial variation at the local level. While the geographic distribution of teachers is generally aligned with the distribution of the population as a whole, college-educated workers in non-teaching professions tend to cluster around urban job markets, and in many of these markets, teachers are at a particular disadvantage. The cost burden rate for primary-earner teachers is higher than that of college-educated non-teachers in 20 of the nation’s 25 largest metros, with a cost burden rate gap of more than 30 percent in 12 of these markets.

Teachers in high-cost coastal areas struggle most. Miami has the highest overall teacher cost-burden rate among the nation’s 25 largest metros at 35 percent, followed by San Francisco, Los Angeles, San Diego, and Washington D.C. Meanwhile, Charlotte, NC has the largest percent gap in the cost burden rates between teachers and non-teachers with college degrees. In the Charlotte metro, 21.5 percent of teachers are cost-burdened, which is 76.9 percent higher than the 12.2 percent of other college-educated professionals who are cost-burdened. We also obverse cost burden rate gaps of more than 50 percent in St. Louis, Phoenix, San Francisco, Washington, D.C., Seattle, and Atlanta.

Conclusion

Teaching is one of the most important professions in our society, but unfortunately, teachers are often not compensated in a way enables economic security. Nationally, one-in-five primary earner teachers are burdened by their housing costs, and in some of the nation’s most expensive housing markets, that figure is more than one-in-three. Widespread teacher strikes and rising attrition rates point to the difficulty of living comfortably on a teacher’s salary. If not addressed, this issue may deter young educators away from the teaching profession, with significant negative implications for the quality of the American education system.

Download Local Data for 50 Largest Metros

Share this Article