Breaking the Bank: Where Is Rent Affordable for Those Earning a Median Income?

Introduction

As more and more Americans have turned to renting in the decade following the housing crisis, the spotlight on rent affordability across the country has also grown. Nearly half of renting households are cost-burdened, meaning they spend more than the U.S. Department of Housing and Urban Development's recommended 30% of gross income on rent. The demographics of renting are changing as well. As homeownership becomes more and more unattainable for millennials, many forego purchasing a home and opt to rent further into adulthood. The increase in the number of renters has strained supply in many markets, even as investment in new multifamily construction has grown back to pre-recession levels, leading to increasing rental prices in many cities around the nation.

In order to better understand rent affordability in our nation, we analyzed median rents in 100 of the largest U.S. cities. We calculated the minimum gross income required to rent these apartments without surpassing the 30% threshold, and compared this income to the actual median household income for the same location. Overall, we found that in 24% of the largest U.S. cities renting a median two-bedroom apartment will cost-burden a median-income-earning renter. We saw similar trends for studios and one-bedroom apartments as well.

Fremont, CA residents need to earn the most money to afford rent out of 100 largest cities

One key trend stands out when comparing incomes and rent. Cities within metropolitan areas with the lowest homeownership rate are being affected the most by affordability issues. San Jose, Los Angeles, New York, San Francisco, San Diego and Boston metros had some of the lowest homeownership rates in the fourth quarter of 2018. This trend might be the reason we see these cities, along with surrounding suburbs such as Fremont, Irvine, Chula Vista and Jersey City, on the list below.

Demand for rental housing drives up rent prices in large cities. As rent prices continue to grow, many people move to smaller, more affordable cities nearby and commute or work remotely. According to our recent study on the rise of super commuters, the share of employees working from home increased by 76% and the share of super commuters, who travel more than 90 minutes to work each way — by 32% since 2005.

Fremont is a clear example of this trend. Located on the outskirts of Silicon Valley, the city attracts tech employees that commute to San Jose, Mountain View and Palo Alto. It’s also home to the Tesla Factory, which employs over 10,000 people and is ramping up its Model 3 production, creating many jobs. As demand for housing in the area grows and is not being met with adequate supply, the rents in the area inevitably increase. Year-over-year growth of median-priced apartments in Fremont reached 3.6%, surpassing the national average of 0.9%. It shouldn’t come as a surprise that Fremont leads the nation as the city where you need to earn the most money to afford rent out of the 100 largest cities. In fact, it’s the only city on our list that requires its residents to earn a 6 figure salary to rent a median-priced 1-bedroom apartment. It’s also on the top of the list for studio apartments and 2-bedrooms.

Median 2-Bedroom Apartment Rents and Recommended Salary

Households earning the median income in New York City and Newark will be cost burdened when renting a median-priced studio apartment

Monthly rent for median-priced studio apartments in New York City and Newark stand at $1,914 and $1,070 respectively. To afford a median-priced studio in New York, one would have to earn $6,380 a month (or $76,550 annually). However, median household income in the Big Apple is $59,631 making rent significantly more expensive than the recommended amount. While the gap between the median annual income and the amount necessary to rent a studio in Newark is smaller, it is still significant at $6,847. It’s worth noting that a studio apartment might not be sufficient for an average household. According to the American Community Survey, an average household consists of 2.65 people.

Cities where the Gap Between Recommended Income to Rent a Studio Apartment and Median Income is Largest

Median-priced 1-bedroom apartments are an income stretch for renters in New York City, Newark, Miami, Oakland and Boston

In 5 out of the 100 largest cities, residents earning a median income may need to spend over 30% of their income to rent a median-priced 1-bedroom apartment. Apart from the above-mentioned New York City and Newark, we are seeing Miami, Oakland and Boston on this list.

Since 2010, over 500,000 people moved to the Miami-Fort Lauderdale-Port St. Lucie combined statistical area (CSA). However, the supply of new housing hasn’t kept up with the growing demand, despite an increase of investment into multifamily construction. The existing residential construction appears skewed towards luxury housing units, which may stay vacant on the market despite the growing demand for new housing. While Miami is #26 out of the 100 largest cities for the highest median income necessary to afford a median-priced 1-bedroom, it’s #98 for the actual household income.

Skyrocketing housing costs and limited supply make San Francisco increasingly expensive. Oakland, with its proximity to the city, is becoming a desirable location for new startup employees, outpriced renters, and former San Franciscans that no longer wish to deal with crowds and traffic. In turn, the growing demand for rental housing drives the prices up to the point where local residents can no longer afford to stay in the area.

When it comes to Boston, high house prices and tight supply cause a decrease in the homeownership rate. As more people opt to rent, even growing investment in multifamily construction fails to satisfy the increasing demand.

Cities where the Gap Between Recommended Income to Rent a 1-Bedroom Apartment and Median Income is Largest

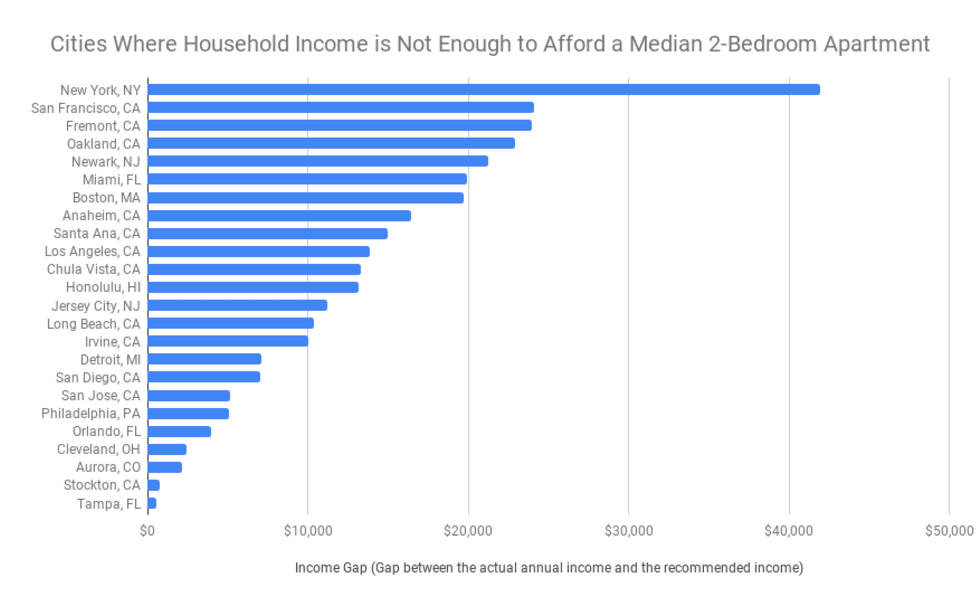

In 24 of the 100 largest cities, median-priced 2-bedroom apartments will cost-burden median income renters

On this list we see more suburbs of large cities with historically high rent prices and falling homeownership rates. At the same time, we also see cities like Cleveland, OH, where median rents are significantly below prices in other cities on the list. This could be attributed to the decreased investment into multifamily construction and increased number of luxury units coming to the market.

Cities where the Gap Between Recommended Income to Rent a 2-Bedroom Apartment and Median Income is Largest

Spokane, WA is the only city out of the 100 largest cities where residents can afford to rent a median-priced studio while earning minimum wage

As we analyzed incomes and rates, it became evident that in all cities except for one renters cannot afford to even rent a studio apartment while making minimum wage without being cost-burden. In Spokane, WA, where minimum wage is $12/hour, a renter only needs to earn $11/hour to afford a median studio that’s priced at $567.

Conclusion

As homeownership is becoming less and less attainable, many forego purchasing a home and opt to rent to avoid down payments and long-term mortgages. Our data shows that the increasing demand for rentals in cities with declining homeownership rates, paired with limited investment in new multifamily construction, cause an increase in rental prices around the nation. The new construction that is taking place does not always positively affect rent prices, as, oftentimes, it consists of luxury apartments targeted at the growing number of high-income renters.

Methodology

- To conduct this study, we used Apartment List rental data for the fourth quarter of 2018.

- To calculate recommended income we used guidelines outlined by The U.S. Department of Housing and Urban Development. According to them, anyone spending over 30% of their income on rent is considered cost-burdened.

- We obtained median household income data from the Census Bureau American Community Survey for 2017, and used income growth rates from Bureau of Labor Statistics to estimate median household income at the end of 2018.

Share this Article