Homeowners and renters - a widening gap

Homeownership has long been part of the American Dream for many, and is often touted as offering numerous benefits to individuals and local communities. Since the recession of 2007-2009, however, the US homeownership rate has fallen steadily, and recently dropped to its lowest level since 1965.

According to Apartment List's analysis of the Census data, the economic downturn had the greatest impact on homeownership among these three segments of the US population: (1) those in Sunbelt cities like Las Vegas, Phoenix, Orlando, Tampa, and Atlanta; (2) young Americans aged 18-45; and (3) Hispanics and African Americans.

With interest rates near historic lows, the median monthly homeowner payment has fallen 13.0% since 2007. Renters, however, fail to benefit from lower interest rates, and have been hit instead by rents that have increased by 3.7% (both numbers adjusted to 2014 dollars). In Houston, for example, owner costs have gone down by $289, whereas rents have risen by $115.

Our research indicates that not owning a home has a sizable financial cost, as renters miss out on low mortgage rates and are hit by higher rents. This phenomenon may exacerbate inequality in our society, as those wealthy enough to invest in real estate benefit from lower interest rates, whereas minorities and younger Americans, hit by rising rents and student debt, risk being locked out of homeownership.

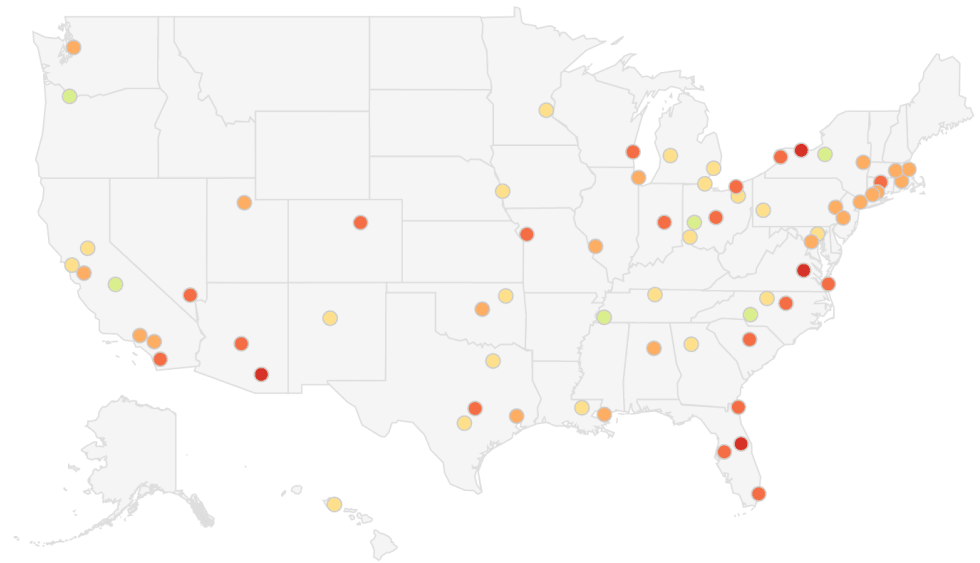

Orlando, Jacksonville, Phoenix, and Indianapolis saw big declines in the homeownership rate

We began by analyzing the change in homeownership rates from 2007-2016, across 70 metropolitan areas in the US. The homeownership rate fell in 57 out of 70 metros, with more than half showing a decrease of 5% or more. Some of the largest declines were in Orlando (-14.2%), Jacksonville (-11.3%), and New Orleans (-6.5%), but there were also large drops in Las Vegas, Phoenix, and Indianapolis. In Orlando, the renter population swelled from 260,000 to 320,000, even as its owner population fell by 2%. This phenomenon was repeated across many cities in the US.

In contrast, cities that had seen relatively moderate home price increases before the recession managed to escape relatively unscathed. The homeownership rate actually increased in Portland (+1.6%) and Charlotte (+0.8%), and only fell slightly in Dallas (-2.2%).

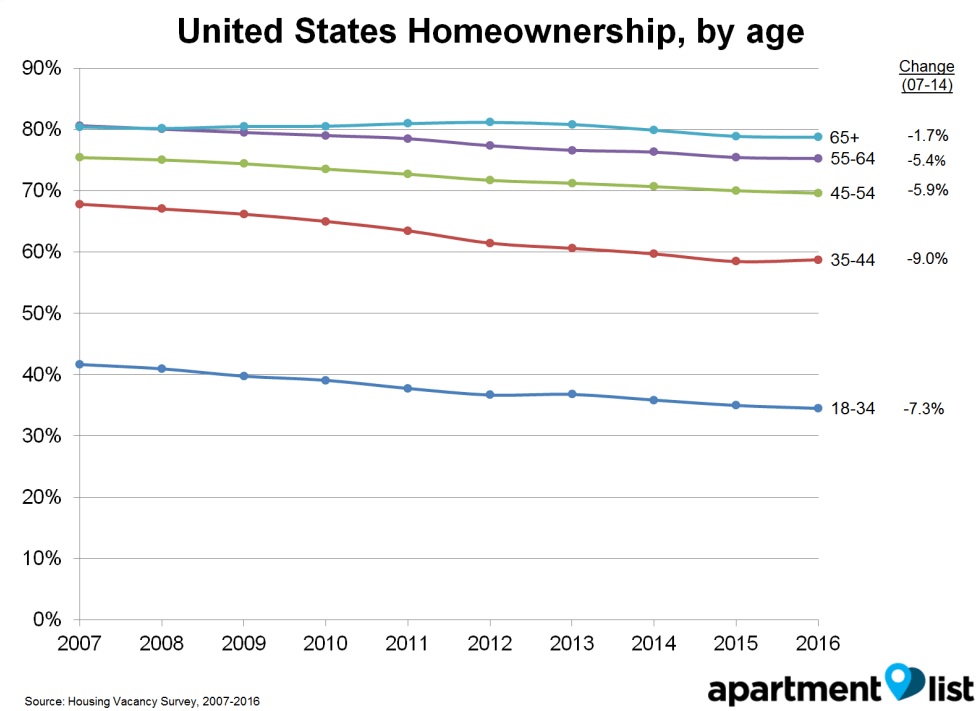

The homeownership rate fell among most among millennials and adults aged 35-44

Next, we looked at the change in homeownership rate for different age groups. Worryingly, the hardest hit by the recession were Americans aged 35-44, who are often first-time homeowners or young families. The homeownership rate among this segment fell from 68% to 59%. The group that was next most affected was millennials under 35 years old, many of whom have delayed homeownership as a result of the recession.

In contrast, older Americans have been less affected. Among those aged 55-64, the decline in homeownership has been more moderate, with a rate decrease of about 5.4%. This group is closer to retirement, however, and a shift from owning to renting may be permanent. Only those aged 65 or older seemed to fare better, as the homeownership rate increased by 0.4% between 2007 and 2013, before falling relatively slightly.

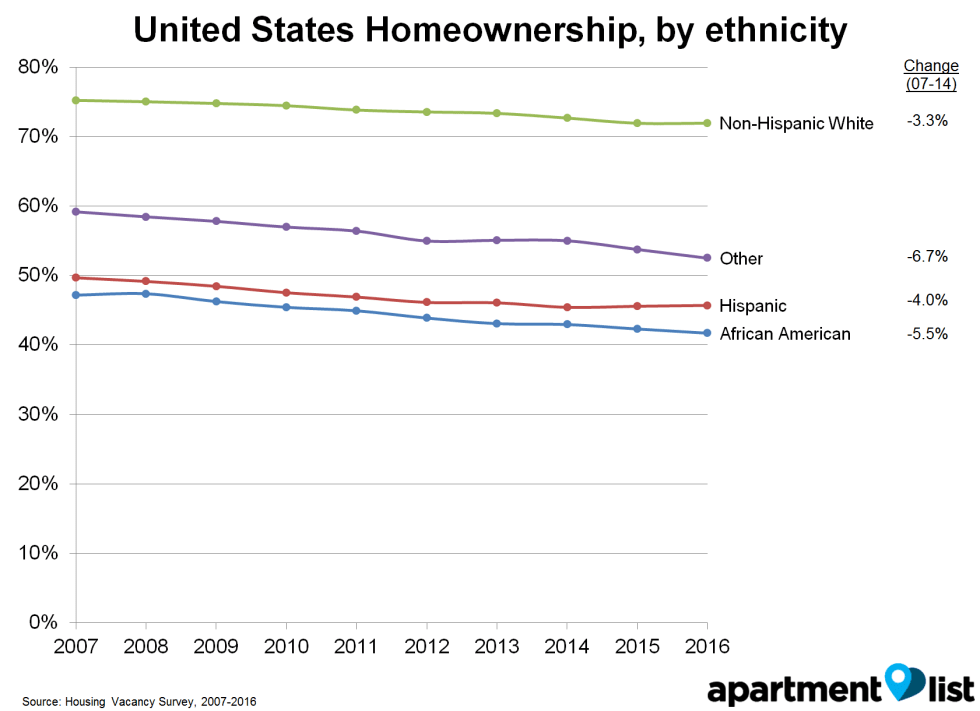

African Americans and Hispanics were hit the hardest by the housing crisis

Looking at the data by ethnicity, we noticed that minorities seem to have been the most affected by the housing crisis. The largest declines in homeownership occurred among Hispanics (-4.0%), African Americans (-5.5%), and other minorities (-6.7%). Non-Hispanic whites were relatively less affected, with a homeownership decline of -3.3%.

Falling interest rates have reduced mortgage costs, even as rents continue to climb

The homeownership rate has declined across the United States, with the sharpest drops falling among minorities and young Americans. But what are the implications of this shift from owning to renting? Rents have skyrocketed in metropolitan areas like Denver and Seattle, as the renter population has swelled. Many homeowners, on the other hand, have benefited from lower interest rates, refinancing their homes to reduce their monthly mortgage payments.

To quantify the impact of these factors, we analyzed Census data on inflation-adjusted median owner costs (for those with a mortgage) and median rents, from 2007-2014, the latest year for which data is available.

We find that the median monthly cost of owning a home has fallen by 13.0% since 2007, in inflation-adjusted terms. The median owner with a mortgage had a monthly payment of $2,754 in 2007, but with the number of owners who refinanced following the fall in interest rates, that payment dropped to $2,263 - a difference of nearly $6,000 annually. Given that the median household income was ~$54,000 in 2014, this represents a sizable savings.

Renters, on the other hand, did not do as well. The median national rent increased by about 4%, from $901 to $934. The difference is not huge (only $33), but still meaningful, especially considering that inflation-adjusted renter incomes fell by 14% during that time period.

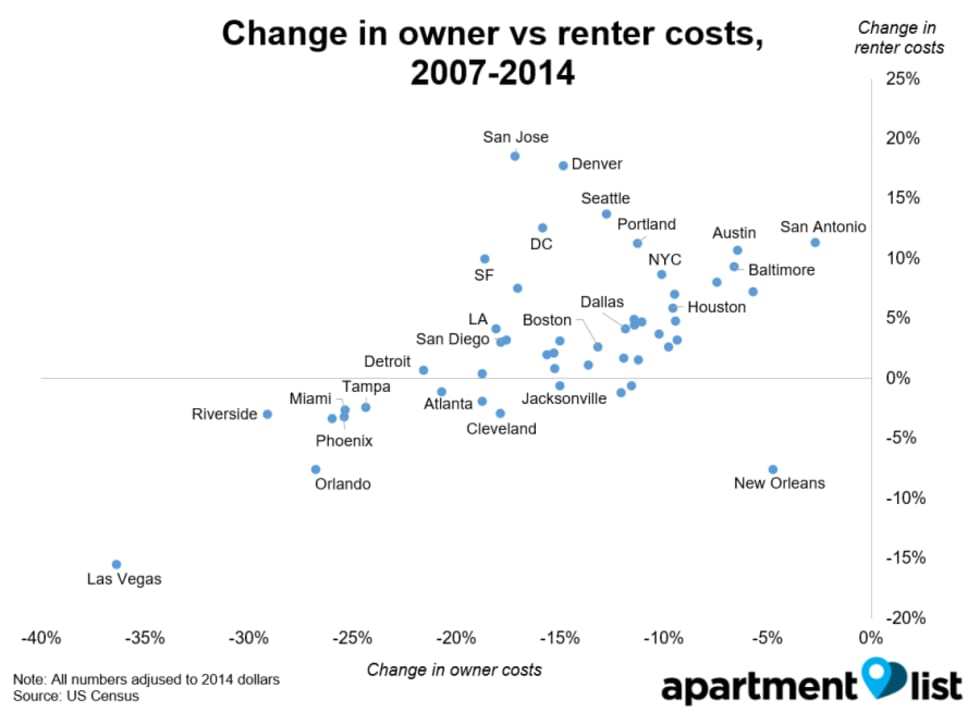

Owner costs fell across the board, even as rents climbed in many metros

Next, we looked at how these numbers varied across major metropolitan areas in the US. Out of the 347 metros we studied, owner costs fell in 331 of them (95%). In Las Vegas, for example, monthly mortgaged owner costs fell from $2,095 to $1,333, an annual savings of $9,144. Even owners in metros that were relatively unaffected still saw large savings: Boston owners, for example, saw costs fall from $2,534 to $2,200.

Renters, on the other hand, did not do quite as well. Rents in many metros increased, especially in cities like San Jose (18.6% rise), Washington DC (12.5%), and Seattle (13.7%). The increases were especially large in coastal cities popular with millennials, but some inland cities like San Antonio also saw significant increases.

Nearly a decade after the housing crisis, has America recovered?

It has been nearly a decade since the Great Recession, and the housing market looks much improved. Home prices have recovered, and foreclosure rates have fallen (although both metrics are still slightly worse than pre-recession levels). Despite this, homeownership rates remain near historic lows, and have fallen most among younger Americans and ethnic minorities.

Our analysis highlights the challenging situation many renters face. Most desire to purchase a home, but are unable to afford it. Delaying homeownership has a sizable financial cost, as renters miss out on low mortgage rates and are hit by rising rents. Over time, these trends may exacerbate inequality in our society, and risk locking many Americans out of homeownership.

Notes and methodology

We obtained homeownership data from the American Housing Survey, for 2007-2016, and calculated changes in homeownership rate based on averages for the year. Median owner and renter costs were taken from the American Community Survey, with numbers being adjusted to 2014 dollars using the CPI. Median owner costs are for owners with a mortgage, and include mortgage payments, real estate taxes, insurance, utilities, etc.

Share this Article