The Top 5 Rental Trends You Need to Know Right Now

The rental market is constantly evolving, influenced by economic shifts, demographic changes, and societal trends. As property managers and investors navigate this dynamic landscape, it's crucial to stay informed about the forces shaping the industry.

This blog post dives into five key trends impacting the multifamily rental market, drawing insights from a thought leadership session by Igor Popov, Apartment List's Chief Economist, at Apartmentalize 2024. Our goal is to help you cut through the noise and hone in on the top trends to keep an eye on as you devise strategies to navigate the market. To watch the full session from Apartmentalize, see below.

At a glance the “big five” trends Igor outlined are:

- Rent Roller Coaster: Rent growth has become unpredictable, moving away from the typical 2-3% annual increase.

- Multifamily Supply Wave: A surge in multifamily construction is creating a supply wave, expected to last through 2025.

- New Choices, New Competition: Renters have more options, including build-to-rent single-family homes and short-term rentals.

- Untethered Work & Living: Remote work is changing where people choose to live, with less emphasis on proximity to workplaces.

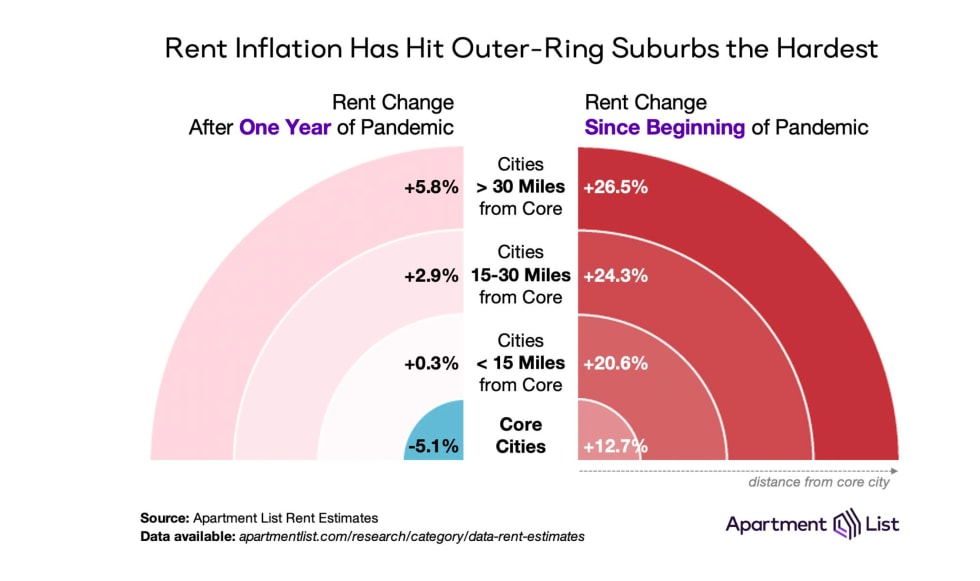

- Shifting Location Preferences: There's a continued trend towards suburbanization, with stronger rent growth in areas over 30 miles from city centers.

For a full synopsis of Igor's session, continue reading below.

The Rent Rollercoaster: Unpredictable Growth in a Post-Pandemic Market

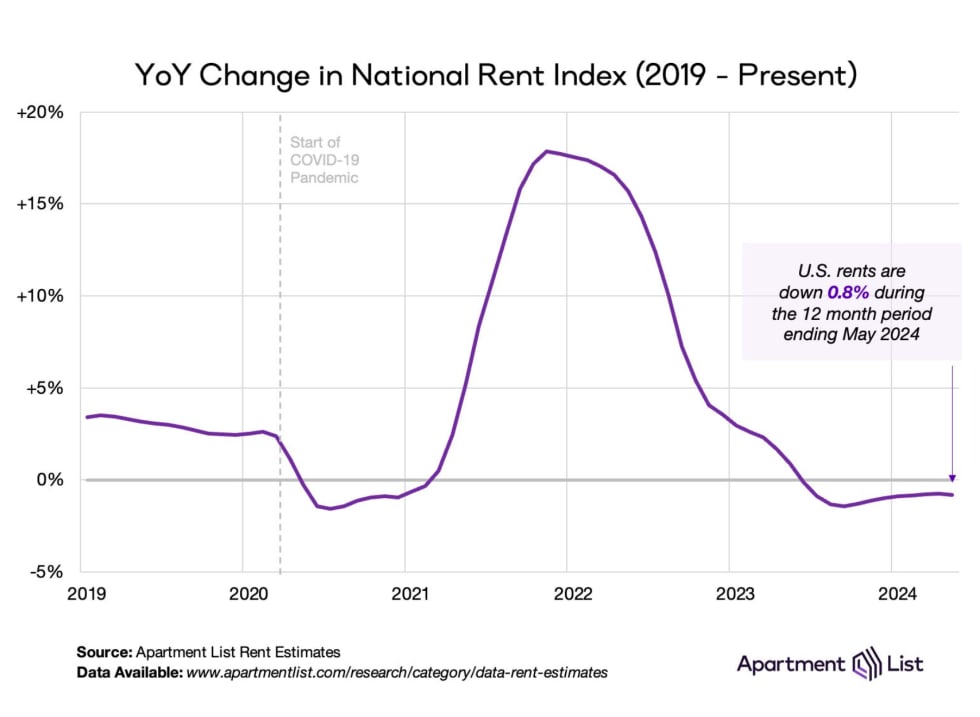

Gone are the days of predictable 2-3% annual rent growth. The market has experienced significant volatility in recent years, with periods of steep declines followed by rapid increases.

Igor explained: "We have not yet had a typical stretch of rent growth in this decade so far. Right? As the pandemic broke out in 2020, we saw rents in our data fall pretty precipitously, really driven by the large markets like San Francisco and New York throughout the country. And then this is where we started riding up the rollercoaster, getting ready for what was coming next with a big explosion in housing demand in 2021, followed by a real quick cooling."

He’s referring to 2022 and much of 2023, which have seen a cool-down period, with rent growth lagging behind pre-pandemic levels. This unpredictable pattern makes financial planning a challenge for both renters and property managers. This "rent rollercoaster" necessitates a more agile approach to pricing strategies. Property managers should be prepared for continued fluctuations and adapt their policies accordingly.

The Multifamily Supply Wave: A Glut of New Units Puts Pressure on Rents

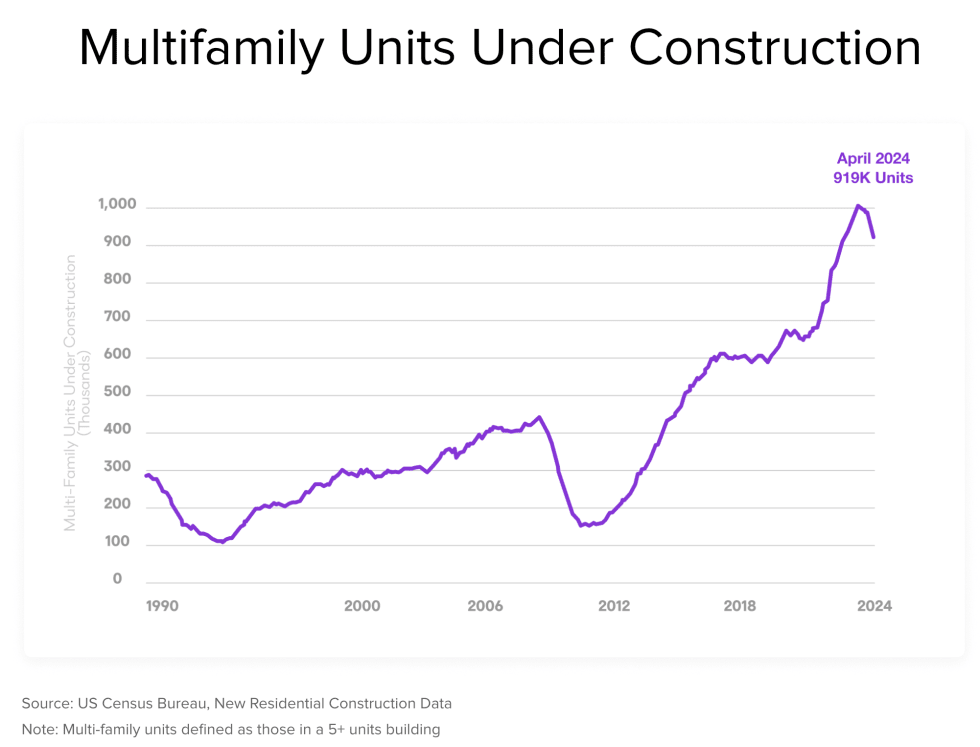

The United States is currently experiencing a wave of multifamily construction unlike anything seen in recent history. This surge in development has resulted in a record number of units being added to the pipeline.

Igor highlighted the scale of this trend: "We've seen just a wild run-up to basically a million units in the construction pipeline earlier this year. And this is coming down now, which means that these units are coming online faster than new units are entering the construction pipeline. So again, fierce competition is going to be a key theme."

This abundance of supply is expected to last through 2025, putting pressure on rents and creating a more competitive landscape for landlords, particularly in sunbelt markets. While some predictions anticipated a slowdown in construction activity due to rising interest rates, the backlog in the pipeline is substantial enough to ensure a steady stream of new completions throughout 2024 and likely into 2025. This means that a renter-friendly market with lower rent growth is likely to persist for the foreseeable future.

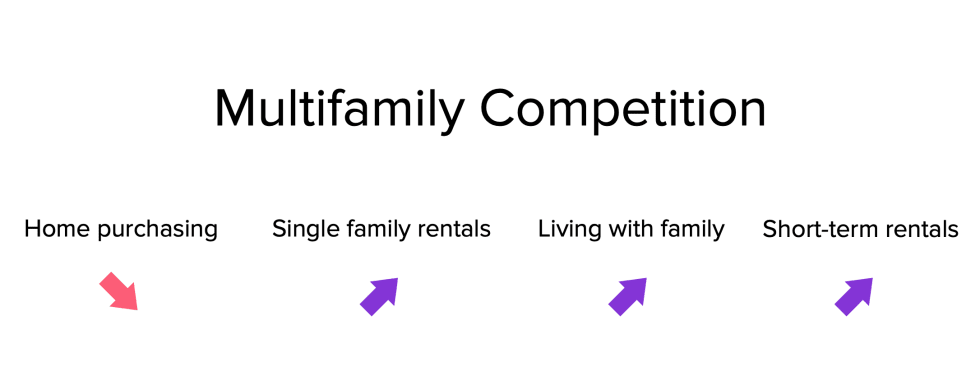

New Choices, New Competition: Renters Have More Options Than Ever Before

The rental landscape is diversifying beyond traditional multifamily communities. Build-to-rent single-family homes, short-term rentals, and living with family are all competing for potential renters' attention.

Single-family rentals, typically houses or townhomes managed by professional companies, are becoming increasingly attractive to those desiring more space, privacy, or a backyard for pets. Short-term rentals, often listed on platforms like Airbnb, offer flexibility and unique living experiences, appealing to those seeking temporary housing or exploring new cities.

Igor noted that "renter choices are getting much more dynamic," highlighting the rise of single-family rentals, "We've got almost another 100,000 getting permitted for build-to-rent single family rentals." He also pointed out an often-overlooked competitor: "One in three young adults live in their parents' home... they can come out of the woodwork when conditions are right for generating new households that actually enter the rental market."

This surge of alternative housing options necessitates that multifamily property managers adapt their strategies to stay competitive in this evolving market.

The Untethering of Work and Life: Remote Work's Impact on Location Preferences

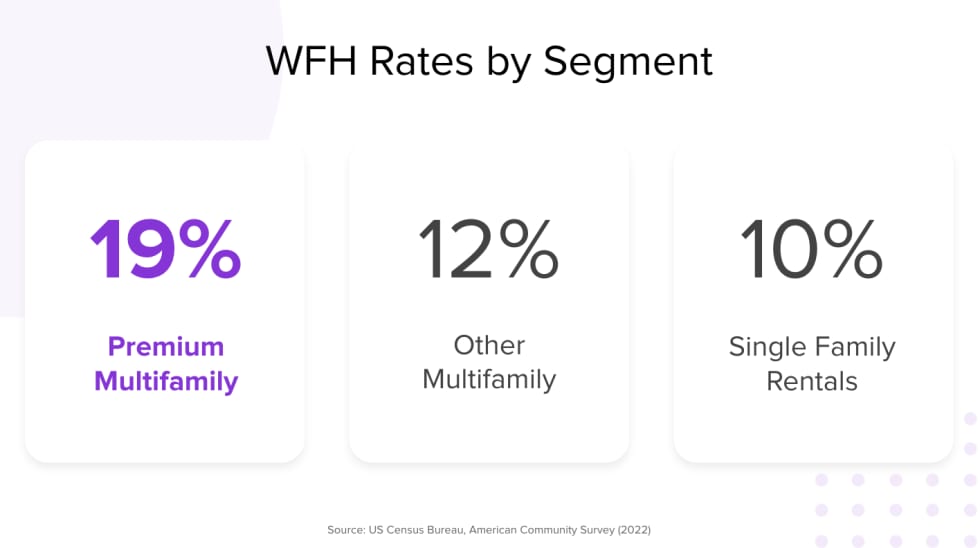

Remote work has dramatically altered the relationship between where people live and where they work. This shift is particularly pronounced in the multifamily sector. Traditionally, job growth in a local economy has been a primary driver of rental demand. However, as Igor explained, "we're seeing something interesting happening where increasingly work choices and location choices are getting untethered."

This means that renters are no longer limited to living near their workplaces and can prioritize factors like affordability, amenities, and overall quality of life when choosing a residence. Popov shared a striking statistic, "When we look at class A recently built multifamily, you actually see that almost double the penetration of remote workers are in the segment of essentially the new supply that's coming online today in our industry."

He added, "When you look at high income renters that moved in the last year of the census, 42% of them moved to a place where they were going to be working from that home environment." With that in mind, amenities and features that cater to work-from-home lifestyles could become key differentiators in the market.

Shifting Location Preferences: The Suburbanization Trend Continues

The "suburbanization" of renter preferences continues, with many opting for locations further from urban cores. The strongest rent growth is occurring in areas over 30 miles from city centers. This trend is driven by desires for more space, affordability concerns, and the rise of remote work. Igor noted, "This donut effect is still very much there," emphasizing that "suburbanization of preferences has continued to play a really important role in how renters are voting with their feet."

This shift is evident both within metro areas and nationally, with Sunbelt and Mountain West regions seeing significant population gains.

For multifamily landlords, this trend presents challenges and opportunities. Urban properties may face increased competition but can attract renters by highlighting proximity to job centers, cultural attractions, and nightlife. Suburban properties can capitalize on desires for space and quieter environments, while offering amenities catering to remote workers, such as co-working spaces and high-speed internet.

From Insights to Action: Revolutionize Your Leasing Strategy Today

By staying informed about these five key trends and adapting your strategies accordingly, you can position your rental community for success in the ever-evolving market. To thrive in this evolving market, property managers and investors should:

- Stay flexible with pricing strategies to navigate rent volatility

- Focus on differentiation and unique value propositions in competitive markets

- Consider adapting amenities and unit designs to accommodate remote work

- Pay close attention to location trends within your market and nationally

- Explore innovative leasing and marketing strategies to stand out in a supply-rich environment.

By keeping these trends in mind and remaining adaptable, multifamily professionals can position themselves for success in the years to come. To navigate this dynamic market successfully, it's also crucial to have access to innovative leasing solutions.

Apartment List's Smart Leasing Platform is designed to help attract high-quality renters in this competitive environment. Don't let these market shifts catch you off guard – reach out to Apartment List today to learn how we can help you thrive in this new era of renting.

Share this Article